Held every two years, albeit now with an additional “half time” conference in London in between the intervening years, the World Space Risk Forum (WSRF) conference in Dubai has become the premier event for space insurers and their clients to attend. This year, the emphasis was on future threats, whether they come be from economic and market conditions, the unreliability of new space systems, or from deliberate human interference.

The economic situation for commercial space

Chris Kunstadter, of XL Catlin, opened the batting by noting that more commercial, geostationary, communications spacecraft were being built towards the smaller 3,500 kg size to fit into the “Ariane lower position gap”. By contrast, he noted that the very largest satellites were getting even larger as the technology of electric thrusters advances. Tim Fuller, of Seradata, showed how the company’s Seradata’s own data showed the same effect.

Fuller warned that while the order book was full, GEO communications satellite orders were down for this year. While fixed communications satellite services were now under threat from fibre, nevertheless, demand for “any” communications capacity, including satellite backhaul, was likely to rise given that most IP traffic was bandwidth hungry – especially for mobile video services.

Khaled Balkheyour, President and CEO of Arabsat, looked forward noting that the key words for the future of satellite operators would be “connectivity and high-throughput data”.

For the time being, however, fixed satellite operators’ revenues are down. “All operators are having a tough time.” said Hadi Alhassani, director of satellite control at Arabsat. Alhassani further explained that while he did not like the increased risk, to survive operators would have to increase innovation on their satellites. But insurers remain concerned because, from past experience, innovation can detrimentally affect reliability, at least in the short term.

While GEO satellites remain the mainstay of commercial satellite activity, the growth of LEO constellations is regarded as having a variety of threats and opportunities. While currently a major driver of the world’s satellite construction and launch industries, insurers fret over the speed of deployment and how this might cause several satellites to be launched before there was time for a generic fault to be detected.

With respect to their economic prospects John Celli, of SSL (formerly Space Systems/Loral), was more dismissive of LEO constellations, sayng that the satellites would need replacement every six years or so. He appeared to doubt whether sufficient revenues would be available to allow this to take place.

Dr Michael Menhart, an economist at Munich Re, openly wondered whether there was too much hype about these LEO constellations. He also explained that a bubble might be inflating in the World economy which could threaten the space industry if it ever burst. Menhart noted that there was uncertainty related to the Chinese and concern over the UK’s Brexit decision. Nevertheless, Menhart said that in the longer term increasing digitalisation and data use would be major drivers for world economic growth, but warned that increasing protectionism might result in a decline in world trade.

“New space” has hurdles to overcome to get itself financing

Raising finance for space projects has always been an issue. After getting their fingers burned by the bankruptcies of the original Iridium and Globalstar projects, financiers for a time eschewed the world of space. Nevertheless, as time has progressed, finance has again become available for space projects. But there remain hurdles for “new space” start-up firms.

Jose Mariano of the start up, balloon-launched, rocket firm, Zero-to-Infinity, commented on the fears: “There was a perception that investing in space is like a Viking funeral [for investors’ cash]. We need time to explain it.” he said.

Luca Rosetti, of D-Orbit, likened the “New space” industry to the pharmaceuticals sector: “It needed a large amount of capital up front,” he said. Daniel Campbell, of Effective Space Solutions, said agreed and explained that one issue was that before you get to space, there were few other milestones that could be effectively demonstrated to finance houses.

Surprisingly, most of the start-up space panel agreed that direct government financing was not wanted as it often stifled innovation and advancement. However, they agreed that government help was still needed in providing a legal framework, helping to backing up private finance with export credit agencies, and to also limit liability cover requirement (and the insurance needed) for such space start- ups.

So where might the financing for the start-ups come from? The USA was one possibility, but Jose Mariano noted that Virgin Galactic’s main investors are in the Middle East.

Failure rates head downwards but so do premium rates – and soon something will have to give

With respect to the space insurance market, whether by chance, good fortune, or improving reliability (Seradata’s figures show a very slow long term trend of improving reliability for both rockets and satellites), there have been few losses this year, promising a bumper result if nothing else goes wrong. Nevertheless, Chris Kunstadter, space underwriter at XL Catlin, warned that premium rates and total premiums were continuing to fall and were now at historically very low rates.

He further noted that there was not enough premium being generated to cover the largest examples of total losses. Premiums for this year were are projected to be US$625 million – which is low in comparison with previous years. This writer warned that the rate of decline failure rates of launch vehicles and spacecraft would have to outpace the fall in premium rates if underwriters were to continue to make money.

Richard Parker, of Assurespace (now part of AMTrust), made a similar point about premium income not being enough to cover losses, as he noted that his company’s space premium income had been cut somewhat by the Falcon 9’s on-pad failure and subsequent delays to its launch schedule. Kunstadter agreed that there had been a rapid fall off of expected premiums and that this was expected to continue for the rest of this year.

While traditional space launch and in- orbit premium rates continue to fall, Richard Parker mentioned that premium rates for pre-launch insurance (on the cargo market) had risen dramatically risen following the failure. “I have heard that loss was equivalent to 20 years of premiums,” he said.

While premiums are mainly generated by the launch part of most space insurance policies (i.e. the vehicle rather than the satellite) Kunstadter stated that the majority of space insurance claims were actually caused by in-orbit failures, According to him, the first-year in-orbit failure rate is currently running an at 3% which chimes with closely to the additional “plus one” element of insurance premiums added to launch policies for the post separation phase and extra year in orbit. (By the way, Seradata’s own analysis puts this satellite launch phase and first year failure rate for commercial GEO satellites at circa 4-5%).

Kundstadter noted that 70% of all GEO commercial satellites and 92% of the satellite value in GEO was insured (i.e. new satellites are more likely to be insured than older ones). While failure rates are normally highest in the first year of a satellite’s life, launch- plus multi- year policies continue to split opinion in the space insurance market. Some underwriters remain fearful of being caught with ever worsening anomalies (and hence losses), as they have been in the past using such policies. However, satellite operators do want multi-year cover as they regard the current annual renewal of in- orbit policies with scepticism, especially as underwriters can (and do) introduce exclusions that which eventually makes the insurance worthless.

This writer has long suggested a middle course. That is to have multi-year policies post the “high risk” first year, and there are signs that this is now happening. After chairing ahis panel, Peter Elson, of JLT Risk, noted that his broking firm had introduced a continuously rolling in- orbit insurance policy, which had a long cancellation notice period (of up to two years). He reported that this was proving to be attractive to clients.

Differentiation does occur between launch vehicles and satellite bus designs/platforms but some complain about it. For example, while most accept that Russian launch vehicles should have higher insurance premium rates due to their higher failure rates – others complain the differentiation is not being done fairly. One of these is Stephane Israel, Head of Arianespace, who claimed that his competitors were getting rates close to that for the Ariane 5 despite having much worse reliability. This was taken by the audience to be a veiled attack on the low premium rating of SpaceX’s Falcon 9 launch vehicle.

John Celli, of SSL, who received a WSRF award for his contribution to the space industry, acknowledged that new innovation provided challenges to maintaining reliability. However, he remained confident in his own product line. “When the customer is happy, the customer comes back,” he said.

Mark Spiwak, of Boeing, noted the reluctance of clients to carry new innovations on their satellites, preferring to do so after someone else had flown it first. “The customer always wants somebody else to take the risk.” he said.

Having previously described that how the normally achieved “Nirvana” state, is usually reached at the end of a learning curve for most launch vehicles, and this writer explained that the effect also held for most new satellite bus designs.

As with rockets, after a rocky start with initial examples, new bus designs normally settle down to excellent reliability after the teething troubles have been ironed out.

Mind you, this was not always the case and there are some notable exceptions to this rule. This writer declined to directly identify the launch vehicle and bus designs concerned (well, apart from a few amusing clues – well amusing to him at any rate), but noted that the causes were due to a number of factors including: continuous modification (never having a chance to “settle down”), poor design and complicated firing sequences, and finally, poor quality control.

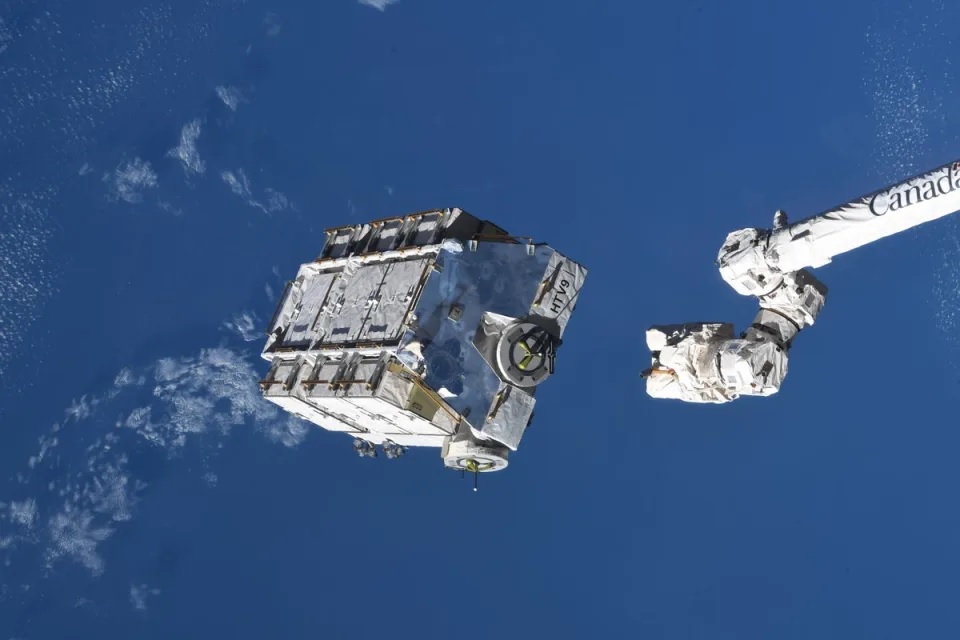

Threats to reliability: Debris threats and maiden flights make underwriters fret

Debris risk continues to fascinate attendees at this conference. Dr Darren McKnight, of Integrity Applications, in his “The Mean is Meaningless” talk explained that the risk debris was probably more serious than appreciated since noting that exploding rocket stages remained a hazard. He also reported that mathematical modelling techniques were likely to significantly under- report the chance of a debris strike. The chance of a major satellite strike by debris in a given year should be 1 in 2,000 rather than 1 in 3,000.

McKnight advocated is in favour of drag augmentation devices, such as drag sails, which would shorten decay and hence re-entry times. This was somewhat against the opinion of the UK Space Agency’s Chief eEngineer, Richard Crowther, who suggested at the recent Rispace conference in London, that increasing the surface area also actually increased the chance of a strike, countering the benefit of an early disposal.

On the subject of tracking, Mark Skinner, of Boeing, cheerfully announced that optical tracking was much better than RF (i.e. radar) systems at taking accurate measurements of spacecraft locations for space situational awareness.

Pascal Lecointe, Space Underwriter at Hiscox, expressed concern that brand new launch vehicles, such as the Ariane 6, H-3, Angara, Vulcan and Falcon Heavy, were soon to be introduced, given that they historically have a high chance of failure.

Seradata’s records indicate that the flight failure rate for maiden flights of brand new launch vehicles introduced since 1990 is 46%. This writer pointed out that it was the introduction of new launch vehicles during the 1990s caused noticeable “blip” increase in the overall launch vehicle failure rate, which was nearly doubled to 10%.

Still, at least most Western (plus some Japanese, Chinese and Indian) launch vehicles and satellites improve with experience, with most achieving the “Nirvana” state of near having zero (or nearly zero) further failures as experience grows.

Ryo Nakamura, of Mitsibushi Heavy Industries, argued that innovation in new launch vehicles could actually increase reliability in the longer term. As an example he described how Japan’s new H-3 launch vehicle would have a simpler engine cycle for its first stage. Meanwhile, he reassured the audience that any items produced using novel 3-D manufacturing techniques would still be given under the same level of inspections as items built using traditional techniques would be.

Stephane Israel had earlier expressed his admiration for his engineering team’s plan to maintain the new Ariane 6 rocket’s reliability, despite its new innovations.

International Launch Services (ILS) had used the preliminary part of the conference to make a technical presentation to underwriters on explaining the technical aspects of its new Proton Medium and Proton Light. These are not really new rockets, but rather reconfiguration of the standard Proton-M, albeit with one less stage and staging event. As such, ILS hopes that these derivative rockets will show an improvement in overall reliability.

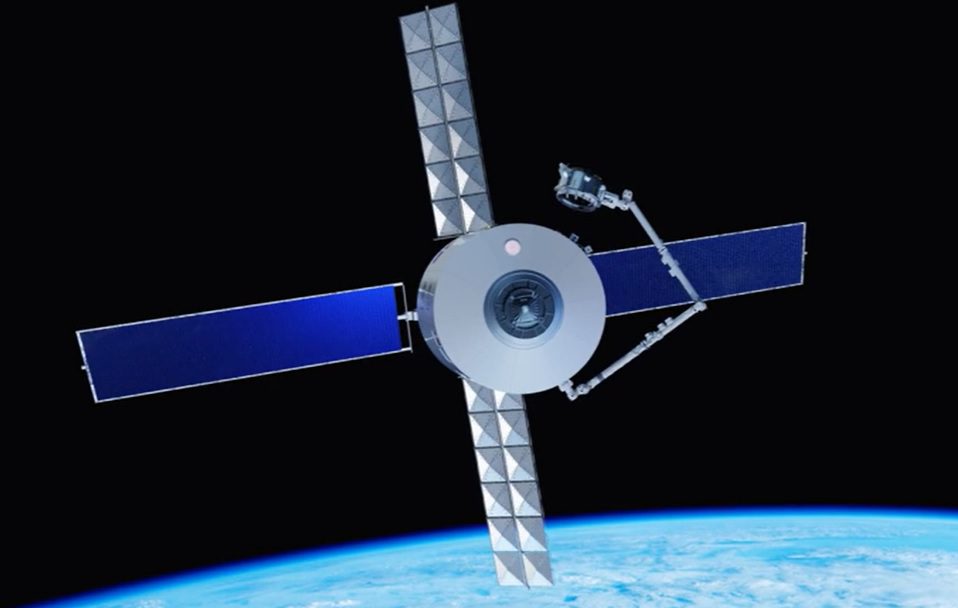

With respect to satellite rescue and servicing concepts, this writer’s analysis of past GTO launch “stranding” events found that only about two or three GEO satellites in the last five years would have actually benefited from being refuelled after rescuing themselves to GEO. In other words, such refuelling/piggy-back control technology would mainly be used by older satellites for basic control and for graveyard disposals in order to lengthen their lives. While such refuelled/piggy-back controlled older satellites might find a use for GEO place holding, they would be commercially much less valuable than newer spacecraft. This casts doubt about the size of the overall market for such rescues/refuellings.

While GEO spacecraft currently account for most space insurance activity, new constellations in LEO are likely to take an increasing share. Ian Praine, of SSTL, did not exactly reassure underwriters in the audience when he said that operators of these new satellite constellations would want to get their satellites to orbit as fast as they could, meaning that many could be launched before an underlying generic fault was discovered. Praine cautioned underwriters that such constellations are actually being designed to allow for some total satellite failures.

Andy Bradford of Bradspace, a consultant to the small launch vehicle industry, expected that new automated testing systems might reduce testing costs for such constellations, but that these have yet to be introduced. While there are several small launch vehicles currently being developed, these would not be initially needed for the new constellations whose satellites would be launched in large numbers by larger launch vehicles. However, Bradford did see a market for regular flights flown by these small launch vehicles (each flying 10-30 times each year) which would be used to send up replenishment satellites in smaller numbers per launch.

The conference was cautioned by this correspondent that the failure mechanisms of composite components (especially pressure vessels) were not fully understood. Bradford agreed but noted that their light characteristics compared with metal structures meant that they would be part of the future.

Reusability may actually increase reliability – or so claims SpaceX

As he stood up to present, SpaceX’s Vice President of Flight Reliability, Dr. Hans Hoenigsmann’s German accent really made him sounds like the archetypal rocket scientist of most people’s imagination. However, he was less than forthcoming when asked direct questions about the suspected failure mechanism of the Falcon 9 on-pad accident. Underlining previous warnings about unpredictable failures of composite tanks, it is thought that a strange solid oxygen phenomenon caused the liquid oxygen submerged composite overcoat of the helium pressurant tank to fail.

After his talk, Koenigsmann told this writer that he did not buy the concept that early flights of new rocket designs would necessarily have a poor flight reliability (even if the evidence shows other wise). By the way, it is notable that SpaceX’s rockets have yet to achieve the at magical “Nirvana” state of a steady near-zero failure rate. Perhaps their rockets have not had a chance to settle down yet?

Nevertheless, during his talk Koenigsmann reiterated his position that reusable rockets could eventually be more reliable than expendable types, as they did provide the capability for more inspection and feedback. Similarly, stored data would be returned and would not suffer from the “bottle neck” that makes data via telemetry so limited.

While discussing why Mars is the obvious first choice for mankind’s interplanetary exploration, Koenigsmann explained that planets such as Jupiter have very deep “gravity wells” that have to be overcome if future missions are to leave their systems.

Other dangers

While Cyber attacks have been comparatively rare to date, they are increasing. Most recently there have been some notable examples of attackers co-opting internet devices on appliances to make mass attacks on networks.

Philippe Cotelle, of Airbus DS, wanted key space personnel to reduce their “public persona” on social websites, such as Linked-In and Facebook, because such data may provide hackers with information that allows malware entry into organisations’ systems via e-mail etc.

Zeina Mokaddem of the satellite operator Inmarsat, noted that most cyber attacks could be fixed via scanning and patching within 72 hours, but although this sounded impressive, this performance was not really good enough. Mokaddem said that rather than relying on reactive systems, threats should be concentrated to head them off on before an attack took place.

Christian Barnaby, of the broker Aon, showed a chart that was not really reassuring about the jamming of spacecraft and said saying its likelihood was becoming very high, albeit that its effects were only classed as medium in effect.

Hijacking and eavesdropping techniques could result in the loss of intellectual property, while business interruption was an ever- present hazard. Insurance against hacking remains a grey area. Hacking by nation states or terrorist organisations would be excluded under the terms of most space insurance policies, but deliberate hacking by an individual would not. Proving who the originator of a hacking attempt is remains very difficult however.

Other industries have their own specialist cyber policies mainly aimed at business interruption insurance. However, when it comes to insuring against business interruption in space, Richard Parker, of Assure Space (now part of AMTrust), explained that insurers would not insure against loss of revenues or profits – the proof of this being too subjective and arguable to be practical – but that they might insure for agreed fixed amounts added on to, say, a satellite policy.

The City of Dubai: Las Vegas on Sea will soon get a Hyperloop superfast tube train… but no tassels

The coastal set city of Dubai is a strange place. Described by some as “Las Vegas without the show girls”, it has a similar a feel to an overly concreted and tower-blocked US city in the middle of the desert, where the automobile is king, and air conditioning is essential. Dubai, which has long been a key port between India and the West, wants to welcome Western business – albeit with certain limits placed on Western decadence and immorality. So no scantily clad showgirls twirling their tassels here.

It was not just the cheap thrills that were absent, so was public transport, or nearly so, apart from a new good over-ground metro to the airport and a limited bus service. That said, Dubai has just announced plans to build a version of Elon Musk’s super-high-tech Hyperloop tube train design, which will run between it and Abu Dhabi at speeds of up to Mach 1 (760 miles per hour).

Nevertheless, for the time being, if you want to travel between these two emirates, or just from between one end of the city to the other, you really have no choice but to drive or take a (cheap) taxi. Even then it might take a long time. For while the traffic flow is acceptably brisk, so bad is the road layout design of this place that you might take 10ten minutes to getting away from your hotel as you spiral out from it “electric thruster” style, passing it three times more on the way.

Dubai is, of course, a member state of the United Arab Emirates. And the UAE has large space aspirations. While most small nations would be satisfied with its pair of successful Dubaisat spacecraft, or with its planned Khalifasat (to be launched by an H2A in 2018), but this rapidly developing technological centre in the desert also has Mars in its sights: it , as its plans to launch the its Hope Probe to the planet in 2020.

It is not just the technological aspects of space that UAE wishes to develop, it also wants in on the other aspects, such as space insurance and , finance.e etc. as well. Thus, it was in one of its many (perhaps too many) very large and luxurious hotels (Fairmont The Palm), that the World Space Risk Forum was held.

On a lighter note: watch out for the two Japanese!

Overall, the conference content was rated as “pretty good” by attendees and “excellent” as for giving a venue for the whole space insurance market to meet up and talk. One complaint, however, was that while WSRF was well attended by underwriters, brokers, reinsurers, and launch providers and manufacturers, there simply were not enough satellite operators (save for the Middle Eastern ones) to go around. Those that were there were jealously guarded by their jealous brokers as if they were in a harem.

Another moan was that the venue, the Fairmount – The Palm hotel, with its very pricey rooms and very expensive meals, was probably too expensive for this gig. Still, at least its toilets/washrooms were classy and clean, even if there could have been more of them. And nt least none of the exhibition stands was ere put next to them this year, as happened to SpaceTrak’s stand at the inaugural WSRF some eight years ago. Mind you, we got a lot of delegate traffic going past that year!

There was, of course, the usual wit and banter on display at WSRF with opponents and competitors jokingly mocking each other and even some space equipment. One underwriter quipped that while most launch vehicles were still prone to sudden unexpected random failures, one launch vehicle (which we will not name here) was now more famous for its sudden unexpected random successes.

While the election of Donald Trump as US President had not yet happened at the time of the conference, the election was clearly on everyone’s minds.

Of course, in trying to prove that the “mean is meaningless”, taking his lead from Trump’s style (if not his hairstyle), your correspondent did his bit for international relations by repeating the jestful advice that an air safety expert had once given him: on any airline flight you should never sit next to the “two Japanese”. Why? Because, on average, in any air crash, there are usually two Japanese passengers in the casualty list.

At this, Japanese-born space underwriter Akiko Hama, of Global Aerospace, said she looked around the rest of the audience to work out which other Japanese passenger she would be sitting next to.

By the way, just to calm your nerves as you reach for your St Christopher good luck travel charm, the per flight fatal accident rate for Western-built jet aircraft is currently 1 per 1 million flights (1 in 10 million for certain jets) – an enviable achievement which puts spaceflight reliability to shame.

On that note your correspondent wishes you God speed and happy lift- offs, cruises/orbits, and landings to you all. Inshallah.

Post Script: Note that the above story was written before the fatal air crash of a chartered Lamia BAe-146 jet near Medellin in Columbia. We give our sympathies to all involved.