After a welcoming introduction to the WSRF London event from Chairman Denis Bensoussan, Space Underwriter at Beezley, the launch providers led off proceedings. New entrants Blue Origin and SpaceX dazzled with their slick presentations. A little more measured where those of the expendables: Virgin Orbit, ILS and Arianespace.

Ariane Cornell, of Blue Origin, was first up and coped graciously with her panel moderator (this writer) making a joke about her name versus the rockets of Arianespace – he warned that it was ok to call Ariane 6 “a heavy Iifter” but not Ariane. Ariane herself went onto give a good account of how new hydrostatic bearings would be included in her firm’s new deep throttling BE-4 engine. Blue Origin’s New Glenn rocket, on which the BE-4 will be used, will have its first stage land on a ship (like SpaceX). However, for stability reasons it will be moving instead of being stationary. There remains surprise at the size of the New Glenn rocket, however, with many wondering if it can ever be filled with enough payloads. If you build it, they will come, apparently remains the hope of Blue Origin.

Jonathan Hoffeller, of SpaceX,was dismissive of concerns about congestion affecting that firm’s flight rate at Cape Canaveral and Kennedy Space Centre, noting that at least on its part, the Falcon 9 rockets’ range safety systems were now independent of many range assets. With respect to reusable operations, Hoffeler noted that there would be a lifetime assessment for each reused part.

Brian Morse, of Virgin Orbit, was challenged over Virgin Orbit’s competitiveness versus new smaller launch vehicles. It intends to orbit 300 kg payloads to 500 km sun-synchronous orbits for US$10-15 million. Nevertheless, Morse reckoned on a per kg basis that his firm could still give them a fight.

Jim Kramer, of ILS, noted how the Proton Medium would be competitive in the LEO constellation market with its payload of 11 metric tonnes. Kramer said that performance was less of an issue than cost and that new payload shrouds/fairings for Proton M and the Proton Medium would be made of metal rather than lighter composites due to its lower cost. Kramer remains confident that past Proton reliability issues are now ironed out.

Cost remains a key driver for Arianespace as its Chief Financial Officer, Michel Doubovick, described how the new Ariane 6 would be 40% cheaper that its Ariane 5 forerunner. It will need to be to cope with the onrush of low-cost reusable rockets and small expendable launch vehicles.

GEO sats in decline but larger satellites still have their advantages

The second panel was about new technology. Setting the scene was Maxime Puteux, of Euroconsult, who described how GEO satellite orders were in decline. Keynote speaker Antonio Abad Martin, Techical Director of Hispasat, said that such GEO satellites were good for broadcasting but did not serve point-to-point on-demand applications so well. As he looked forward to LEO constellations, he noted that satellite lifetimes would be reduced with a consequent increase in launches.

With respect to new technology likely to come on stream in the near future, Craig Clark, of cubesat maker Clyde Space, said that he expected new lower cost attitude and orbit control sensors and cubesat propulsion systems as the next big change in small satellite technology.

Alex Clarke, of battery maker ABSL, described how his firm started by converting commercially available terrestrial batteries to space use. For the time being he foresaw Lithium Ion batteries remaining the state-of-art space battery chemistry, but noted that other chemistries were under test. It was accepted that large satellites were getting larger but that the average satellite size was getting smaller. Clarke noted that 70% of satellites were now under 500 kg and that this was where the main part of the battery market lay.

On the insurance side Christian Barnabe, of the broker AON, reported that “New Space” companies were interested in having both their assets including new technology AND their EBITDA insured.

Ian Praine, of SSTL agreed that imaging satellites were getting smaller and were, in many ways, usurping larger satellites. However, he said that larger satellites still had some distinct advantages especially in Earth imaging, most notably by having larger swath widths. He also said that high data rates were becoming increasingly important for operators as they try to reduce the cost per pixel of data download.

Mike Lawton, of Oxford Space Systems, showed that his firm was rapidly becoming a tech firm to watch. He highlighted its very light deployable structures with a demonstration of one which frightened the front row as he pinged it out like a light sabre. Lawton warned, however, that the introduction of disruptive technologies such as offered by his firm take time to find their full potential.

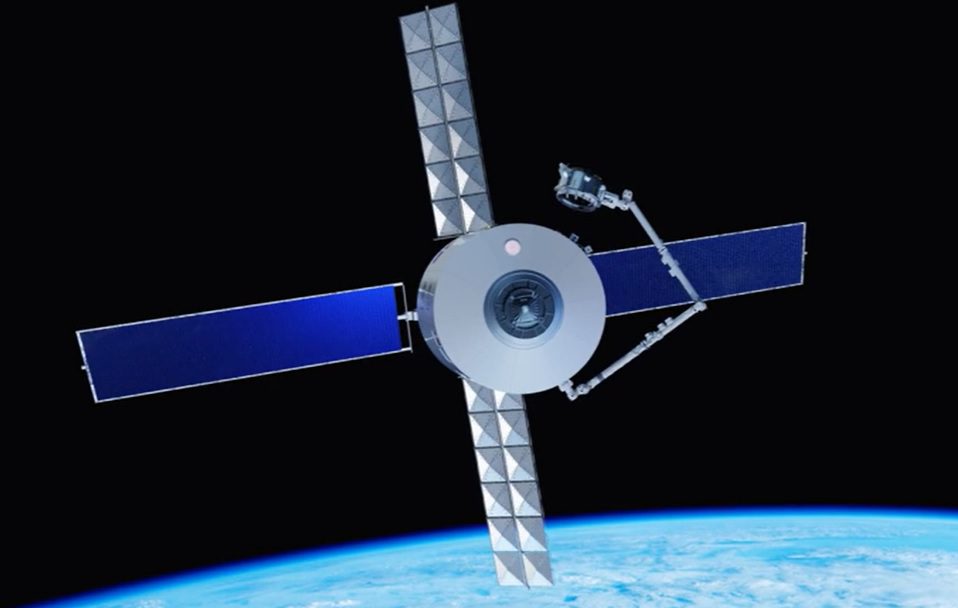

The former astronaut and test pilot Steven Lindsey, now VP Space Exploration Systems at Sierra Nevada Corp, gave an interesting presentation on the Dream Chaser mini-shuttle – drawing some amusing parallels with the Space Shuttle that he once commanded. The Dream Chaser would be in an unmanned configuration to start with and would have an expendable cargo module for cargo delivery, which also allowed the craft to have an increased loiter time in orbit. The former test pilot was especially interesting in the way he explained how safety assessment can go wrong (especially relevant given the terrible tower block fire in London the week of the conference) and how he nearly got killed not taking better care of the testing of a fuse on a bomb he was carrying on his F-16 fighter jet.

While not officially on the panel, Juergen Brandner, of the PTScientists team later waxed lyrically about the Apollo era as he described how his outfit planned to make a bid for the Google Lunar X Prize by landing a small Audi-sponsored rover on the moon.

Brokers quip as vertical marketing is both attacked and defended

The cut and thrust of the insurance panel saw brokers Yamin Mustafa, of Marsh, and Peter Elson, of JLT Speciality, at their quipping best in a kind of double act as they tried to decide which of them would go the way of the dodo. The two underwriters on the panel, Jan Schmidt of Swiss Re and Nishant Choski of Ares Advisors found themselves on the back foot against them, and against the hardline questioning about their own book of risks by the panel’s moderator Peter de Selding.

Looking relaxed before the battle of the insurance panel, Nishant Choksi, Meidad Pariente, Yamin Mustafa, Jan Schmidt, Peter Elson and Martin Benatar. Courtesy: WSRF

While the verbal jousting was all good fun, a note of caution was sounded by finance expert Martin Benatar, who runs his own financial consultancy. He warned that small to medium-sized space operators were ill served by space insurance – especially given a relative lack of business interruption products. In this he agreed with the earlier comment by Aon’s Christian Barnabe.

Benatar was, however, on less sure ground when he called for the ending of “vertical marketing” for market stability reasons. For the uninitiated, vertical marketing is, in effect, a kind of blind auction of risk to all space underwriters. About fifteen years ago this succeeded the previous system of having a lead expert underwriter negotiating a rate and terms with other underwriters following. None of the panellists thought that a return to the old model was likely to happen or necessary, even though other markets still used it.

Against the back drop of the regulatory authorities investigating possible collusion and alleged information sharing between brokers in the related aviation insurance class, vertical marketing is regarded by most in the space insurance market as the more competitive system, which clients, their brokers and competition authorities prefer. Nevertheless, there is concern amongst underwriters that vertical marketing’s lack of transparency as to which underwriter gets what and at what rate, gives too much power to the brokers.

It was generally accepted by the panel that the last year’s excellent space insurance results, which has drawn in even more capital to the market and forced premium rates down even further, are unlikely to be repeated, and that, in this era of dual launches worth over US$750 million, all it would take was just one major loss for premium rates to rise rapidly.

Underwriters are still finalising how the constellations of low Earth orbit satellites will be insured. Third party insurance is likely to become even more important for these given that the debris strike risk and the satellite-to-satellite collision risk is such a concern. Meidad Pariente, CTO and Co-founder of the UK start-up constellation Sky and Space Global, warned that under UK law EACH satellite of a UK-based firm would have to have insurance cover for third party liability. He was concerned that for large constellations this would be unaffordable and called for this requirement to be changed.

Space Debris is a growing threat

While past space conferences have usually had a panel devoted to a new “scare word”, from solar storms to hacking, this conference saw Space Debris take this position in a panel moderated by ASIC underwriter David Wade.

The keynote speech was delivered by Dr Moribah Jah,of the Astria association. He warned that while Two Line Element set (TLE) datawhich is issued by the US Defense Department, is probably accurate enough for debris strike probability analysis (orbital accuracy is not the problem – the debris modelling is), it is not adequate for debris avoidance. While his informal and relaxed style make him appear an unlikely space debris professor, he made an excellent presentation in which he warned the audience that they should consider TLE derived orbits as a very rough orbital location. “Consider it as (when) your friend Jimmy gives you a call to tell you where your satellite is at,” said Dr Jah.

He went onto explain that for tracking to occur it required both the detection and identification of space objects. He also appealed for more use of aircraft style transponders for spacecraft. “If you launch it, make it trackable,” he said.

Dr Jah called for more money to be spent on debris analysis and said this should precede any attempts to take action or pass international laws on debris. He also called for more anomaly disclosure to give more certainty on the risk that debris actually posed.

The notion of TLE derived orbital accuracy being inadequate for collision avoidance was also the sword wielded by the Space Data Association’s Mark Dickinson, who noted that it and partners AGI were also using external sensors and analysis to provide more accurate warnings to GEO satellite operators.

Tim Fuller, of Seradata, demonstrated a new feature of the Seradata SpaceTrak launch and satellite database, which took TLE derived orbital data and used it in combination with NASA’s ORDEM model of debris densities to work out the chance of a debris hit on a satellite in a given year. He noted that TLE data was actually good enough for this purpose – well at least for the larger debris objects.

Fuller cautioned, however,that debris modelling such as NASA’s ORDEM and ESA’s MASTER equivalent system was probably inadequate for debris objects below 1 cm. Nevertheless, using actual historical data he went on to show a rough cut calculation comparing known satellite failures attributed to debris strikes with the number of active satellites in LEO at the time. It showed the current chance of a satellite failure due to a debris strike was about one in 500. He warned that this risk appeared to be increasing.

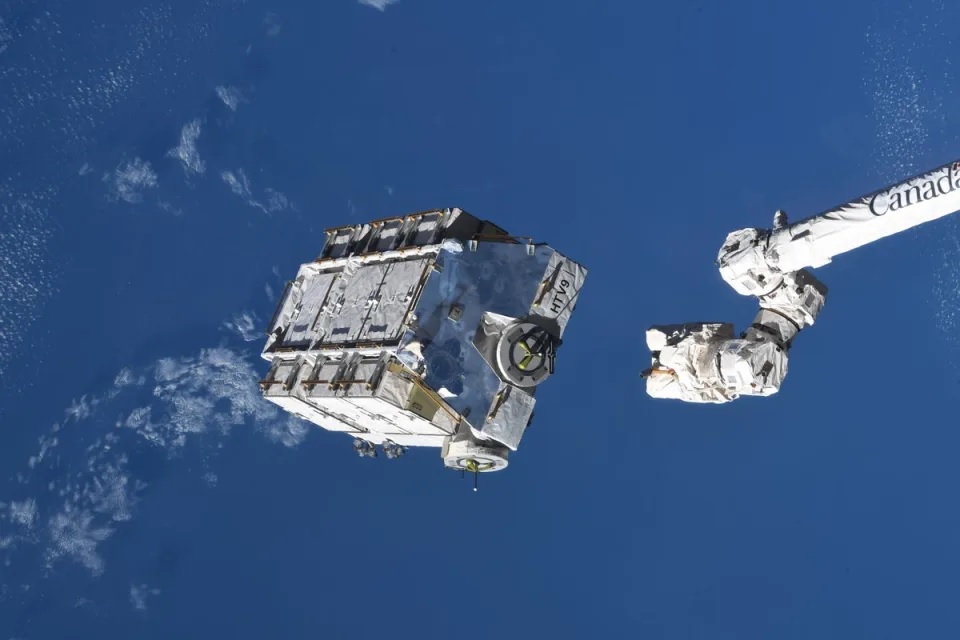

For debris reduction and other reasons, Richard Crowther, Chief Engineer of the UK Space Agency (UKSA),noted that his agency’s (and the Government’s) role in the launching and operation of spacecraft was changing from an authorising authority to a supervisory one. Joe Anderson, of Orbital ATK subsidiary Space Logistics LLC, noted that his firm, hoped to launch its first MEV (Mission Extension Vehicle) in 2018. The test flight plan is to dock with a defunct spacecraft in its graveyard orbit and bring it back to an operational position.

Both Joe Anderson and Daniel Campbell, of his competitor Effective Space, were asked if their satellite recovery systems would have any military application, whether that was recovery of military spacecraft, or even the forced removal of an opponent’s spacecraft. They both skated round the subject but noted that there was a market and that they had had discussions with military authorities.

With respect to using servicing craft, consultant Andy Bradford, speaking from the audience, noted that there would have to be a legal framework to allow satellites to be removed from orbit by servicing and removal spacecraft.

Russell Sawyer, of the broker Willis Towers Watson,noted that when it came to insuring recovery missions and new technology underwriters were willing to be innovative and supportive of new opportunities but also agreed that to some extent this was forced by competitive market conditions.

Conclusion – A very good day

While this writer cannot be entirely unbiased in writing a review given that he was part of the organising committee, all reports and feedback so far received indicate that the conference was very much appreciated. The only major complaint was that more time should have been allotted for audience participation. This was partly a result of the time pressure caused by putting too much good stuff into a single day. The etc.Venue, by Fenchurch St station, was very well received with an excellent food choice and a comfortable room. The shallow room depth along with its extra screens allowed all to see the slides clearly despite some small type on some of the presentations. Only the non-speaking panellists found it hard to see them as they tried to crank their heads round. Perhaps they should have had their own screen. While women attendees often have a justifiable moan at various venues that there are not enough female toilets, at this event the boot was on the other foot as there were not enough male ones – requiring some queueing (the space and insurance sectors are still regrettably male dominated). Still, this was a minor fault on what was generally accepted to have been a very good day. As a result of its success, we may decide to repeat the exercise next year – so watch this space.