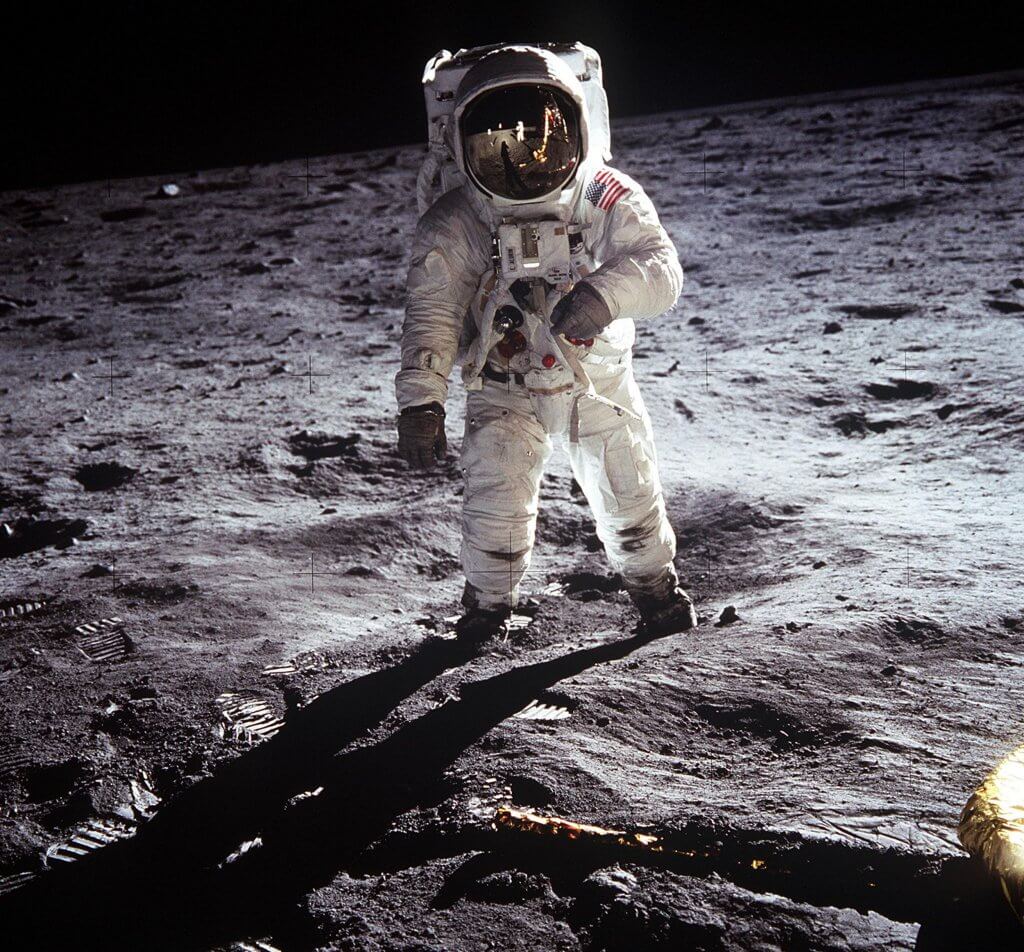

As the 50th celebration of the Apollo 11 astronaut moon landing gets underway, some less well-known aspects of the mission have been revealed. One was that during the late 1950s the UK briefly considered starting a project to mount its own Apollo-11-style human lunar landing – although the cost soon brought this plan back down to Earth. Another was the fact that the actual Apollo 11 astronauts struggled to get life insurance and so came up with their own cunning self-insurance plan.

Neil Armstrong, the first human to set foot on the Moon estimated that the Apollo 11 mission only had a 50 per cent chance of a successful landing. However, the quietly confident and cool-under-fire astronaut reckoned his chance of a safe return was a good deal higher. Despite this, few life insurers were willing to offer a low enough rate for the Apollo 11 astronauts to be able to afford it. NASA itself was barred from taking out insurance by law.

Buzz Aldrin is photographed on Moon by Neil Armstrong (seen in Aldrin’s helmet visor) during Apollo 11’s lunar walk. Courtesy: NASA

While some insurance companies would have given the Apollo 11 crew life insurance almost for free, there was a price: they wanted the publicity. For example, according to BeagleStreet.com, the Travelers’ Insurance Company, based in Hartford, Connecticut, offered to insure the Apollo 11 astronauts, with premiums being paid for by the Austral Oil Company and the Cullen Central Bank. The offer appears to have been politely declined.

One way around this impasse was the ingenious use of signed and stamped postal covers, which the astronauts prepared prior to their mission. The reasoning was that if they did not come back, these would be valuable and could be sold for the benefit of their families. That pseudo-insurance system continued until Apollo 16, the penultimate Moon mission, after Apollo 15 astronaut David Scott created a bit of a scandal by taking some of the covers with him to the surface of the Moon with a view to selling these after his return.

The problem of life insurance for astronauts did not go away. While insurance was still not taken out, it became an unwritten agreement that NASA would compensate families in the event that their loved ones failed to return. This was tested when the Space Shuttle STS-51L Challenger blew up during its launch in January 1986. Seven astronauts were aboard and only one, Christa McAuliffe, actually had proper life insurance – and that was only because of an act of generosity when Lloyd’s of London underwriters, coordinated by the broker Crawley Warren (now Aon), offered her a free US$1 million cover for the mission. Sadly, her family got to collect it.

The failed launch actually did carry some insurance but this was more of a manufacturers’ incentives policy for Morten Thiokol – although the money was, in effect, later used to compensate the families of the crew.

While the crew, prior to the launch, had waived NASA’s liability in the event of an accident, once it happened both NASA and Morton Thiokol did the decent thing and reportedly made compensation payments to the families of astronauts Scobee, Onizuka, Jarvis and McCauliffe. This was reportedly worth US$7.7 million as tax free annuities plus some unspecified extra cash settlements. The relatives of the other astronauts, as well Jarvis’s father, reached separate undisclosed settlements with Morten Thiokol believed to be in the order of US$2 million each.

For the fatal re-entry failure of the Space Shuttle STS-107 Colombia in February 2001, again there was no official insurance claim for the seven astronauts. None were insured despite requests from two crew members that NASA should arrange this. In the end NASA made a compensation payout the to astronauts’ families totalling US$26.6 million, in addition to the military crew’s families receiving their standard in service death compensation of US$250,000 each. No insurance loss was claimed for third party re-entry debris damage, but NASA did pay out US$500,000 to third party claimants.

That is not to say that no insurance payout was made for this launch-related re-entry failure. A US$17.7 million claim was made for the loss of the SpaceHab Research Double Module, which was paid, bizarrely, by the cargo insurance market after the risk was infamously and misleadingly, placed there by wily brokers who knew that the premium rate was much lower than it would have been as a properly insured space risk.

Back to the subject. A few astronauts have taken out their own insurance cover in the past, usually arranged by their respective space agencies to a value of US$2-3 million. The Canadian Space Agency is also thought to have insured its astronauts directly. Nevertheless, most professional astronauts ride into infinity and beyond without formal insurance cover. But will this be the case in future, especially once space tourism really underway?

The two remaining suborbital space ride firms Blue Origin and Virgin Galactic, are planning to offer to arrange insurance for passengers via the personal accident insurance market, but participants will have to pay the premiums themselves. Of course, they are not “passengers” in the legal sense, having signed away their liability claims as part of the deal with the operator. Instead they become “participants” in the flight. Nevertheless, there is some question about whether such waivers will actually insulate the operator in the event of loss, as the participants’ families would not have signed the waiver, and thus could theoretically still sue the firm.

It is not certain that suborbital spaceflight participants will actually take out space insurance given its likely high cost. For example, a US$2 million life insurance cover at a premium rate of say 5 per cent would cost US$100,000 – about half the cost of the actual ride. However, once a suborbital launch operation eventually proves itself to be safe and reliable – say after twenty flights – premium rates would probably fall rapidly.

By the way, the aviation insurance class, with AIG as the lead underwriter, covered the circa US$46 million hull loss of the SpaceShipTwo, which broke apart during a test flight failure in October 2014. The family of the deceased co-pilot Michael Alsbury, is thought to have been directly compensated by Virgin Galactic.

While some doubt remains about whether suborbital space transportation will be a going concern as a long term business, orbital and especially lunar space tourism has a more promising future.

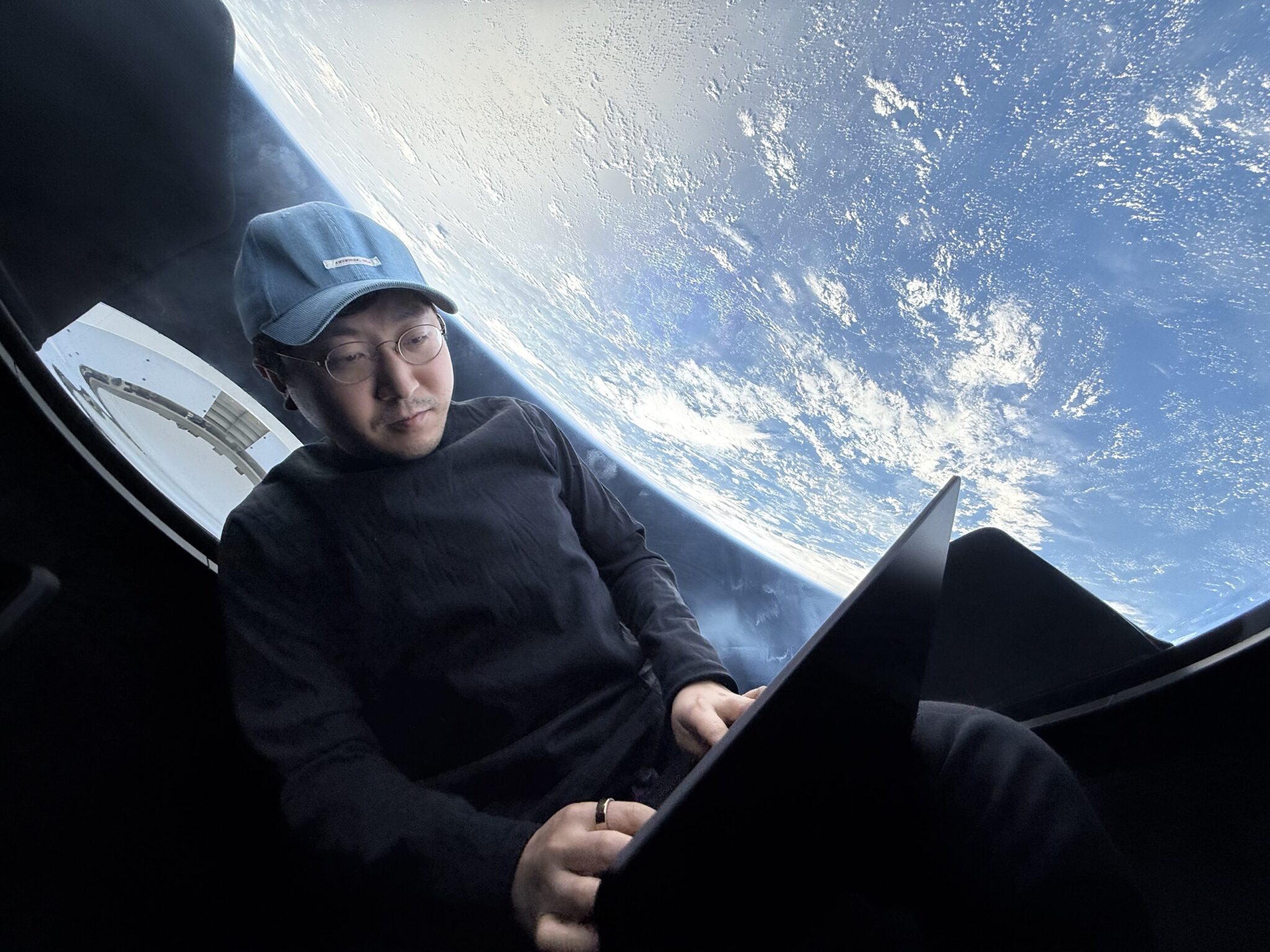

Starting in 2001, “space participant” Dennis Tito travelled to the International Space station (ISS) in low Earth orbit on a commercial contract. Subsequent orbital flights to the ISS were made by space tourists Mark Shuttleworth, Greg Olsen, Anousheh Ansari, Charles Simonyi, Richard Garriot, and Guy Laliberté, some of whom are believed to have taken out insurance. This was often not exactly life insurance (the very rich don’t really need this) but Mark Shuttleworth took out a US$10 million launch replacement insurance cover in the event that the docking had not taken place.

Orbital space tourism has had a ten-year hiatus, mainly because the retirement of the Space Shuttle meant that NASA needed most of the spare Soyuz seat rides. In June this year the hotel and space entrepreneur Robert Bigelow, announced that his firm had booked seats on SpaceX Falcon 9 launches to transport space tourists to the ISS under a US$35,000 a night “hotel room” agreement with NASA. These are likely to start in 2020-21 with the space tourists being charged US$52 million for their launch and return ride. Meanwhile, SpaceX has itself directly booked Japanese clothing billionaire and space aficionado Yusaku Maezawa and his friends for a ride around the Moon via its new Starship/Superbooster combination – probably in 2023 or 2024.

Given that orbital space tourism seems set to continue, there is now a genuine need for some from of fairly rated space tourism insurance.