As the end of the day drew closer at the 2025 Farnborough International Space Show (FISS), the main stage became, briefly, a place for meditation. The unlikely practitioner was self-described “Insurance Guru” Charles Vermont, the Chair of ‘The 695th Lord Mayor of London’s Space Protection Initiative’. Vermont issued a long “Om” chant to signal the start of an appropriately contemplative discussion about how insurers, with the help of regulation, could rescue space from its growing debris problem. Specifically, by using SPADRIBs.

Panel discussion at the UK Space Conference. Courtesy: Farah Ghouri

What is a SPADRIB?

SPADRIBs stand for Space Debris Insurance Bonds. These are, in essence, surety bonds that act as guarantees. The idea is that insurers would have the necessary funds, through the sale of SPADRIBs, to de-orbit failed satellites even if a satellite operator went out of business. Directly addressing operators, Vermont put it simply: “If you don’t de-orbit at the end of a mission, then underwriters will.”

The ambitious goal for SPADRIBs is to become part of regulation. “Once every regulator makes purchasing a SPADRIB mandatory,” Vermont argued, “then it is the end of the game of debris removal.”

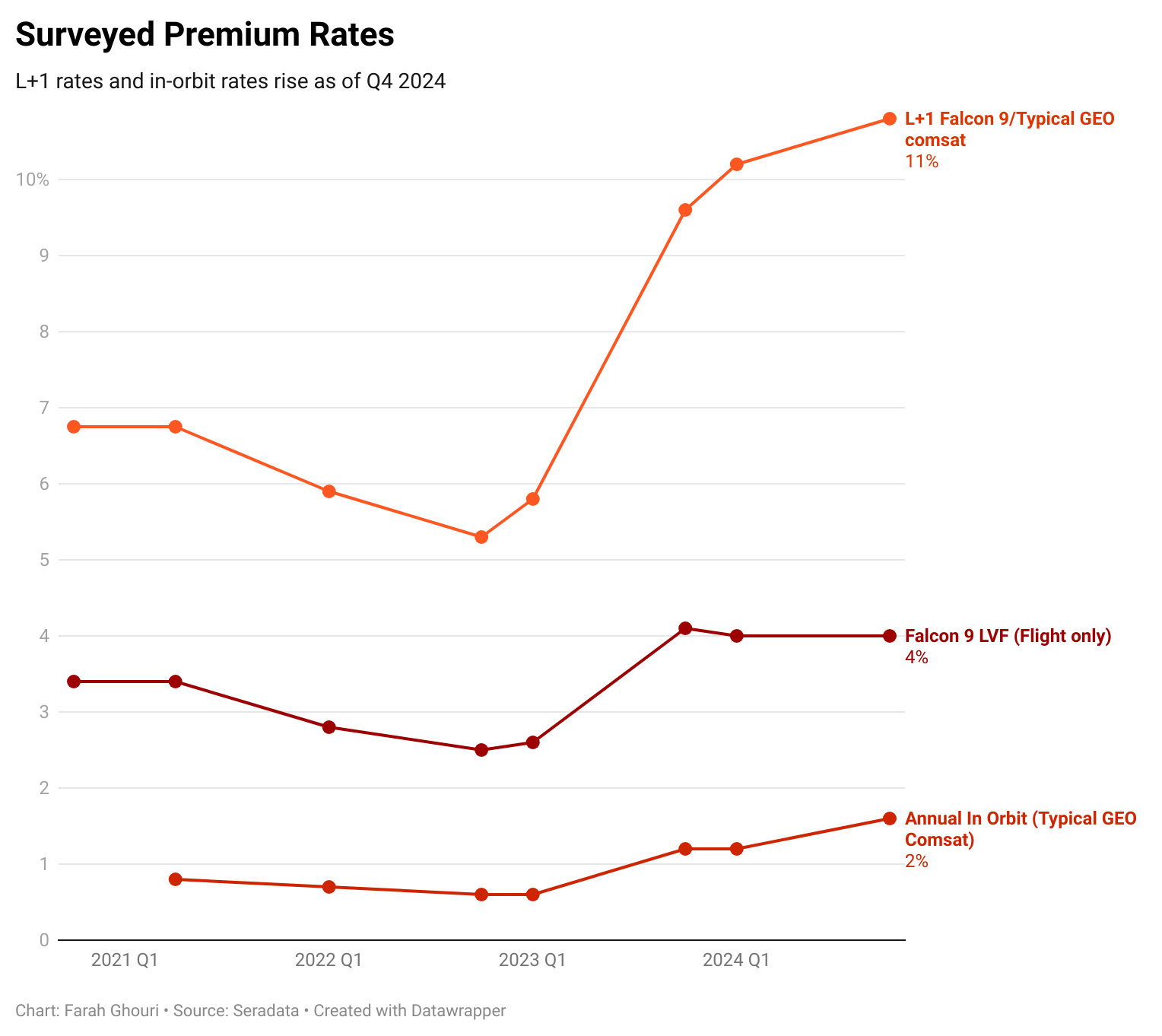

At the Financing and Insuring Space Exploration panel at FISS, there was no beating about the bush as to the motive for insurers: SPADRIBs will, of course, cost a premium. For insurers, the biggest problem is not the removal of debris, but the risk of a satellite operator going bankrupt.

Are SPADRIBs realistic?

The panel was asked how long it might take to gather all the regulators behind the concept of SPADRIBs. Simon Mills, an associate at the consultancy Z/Yen Group, whose chairman Professor Michael Mainelli came up with the idea, admitted that “we know it’s going to take a long time” to reach the ambitious goal. In the meantime, though, he said progress was being made with Canada, the UK, India and Australia. ESA and the US were being “worked on” as his organisation focused on advertising the idea. Z/Yen was also keeping an eye on Russia, while believing that China would be relatively easy.

The global insurance market showed support for SPADRIBs by putting forward an ‘Invitation to Treat’ – which means making a formal opening for others to begin discussions – at up to US$500 million per operator. This was on the basis that “a spacecraft company clearly demonstrates it can de-orbit third-party space debris and that regulatory bodies in respect of space launch make SPADRIBs mandatory.”

Comment by Farah Ghouri: Many talks, panels and roundtables – and there have been very many – tend to say little of substance beyond general agreement that some sort of regulation will be required. While it will clearly be difficult to reach the ambitious goal, it was refreshing to hear about a specific way in which regulation could help with the problem of space debris.