While the US firm Raytheon is best known for its missiles’ business – its Sidewinder infra-red “heat-seeking” air-to-air missile being the most famous, its lesser-known space business actually has a 50-year-old history. And it is thriving, as Wallis Laughrey, Vice President in charge of Raytheon’s space division notes.

Raytheon is not as visible as Lockheed or Boeing in the space sector because the firm is primary involved in building the payloads rather than the spacecraft themselves, explained Laughrey. Nevertheless the Raytheon’s space division is growing fast. “We are a small part of Raytheon, but we are doing very well with unprecedented growth in our business.” Laughrey said.

Laughrey emphasised that sensors were the main part of the space division’s business, taking the example of the primary sensor on JPSS (Joint Polar Satellite System) as being one which Raytheon built. This is the VIIRS (Visible Infrared Imaging Radiometer Suite) sensor, which collects 23 different bands in optical and infrared wavelengths.

In fact, there are several types of sensor in Raytheon’s product line up ranging from those covering missile detection to those concentrating on environmental research. One of these newer types of sensor is the Advanced Digital Focal Plane which converts light to electronic pixels directly, and which have now superseded charged couple device (CCD) technology for image recording.

Raytheon’s clients are primarily satellite manufacturers that award subcontracts for sensor capability. Nevertheless, sometimes it is Raytheon itself which is awarded the “prime” contract to produce the spacecraft, and so it then partners with a bus/platform manufacturer to fulfil the contract.

“Most of the prime opportunities are coming in the future.” said Laughrey, adding that “these will be mostly military”. One of these expected contracts is the US Missile Defense Agency’s “Space Sensing Layer” using infra-red sensors from low Earth orbit. Raytheon was one of several companies selected to work on the design. The final “down-select” for an actual order for sensors will occur later.

While the US Department of Defense has shown interest in fielding a low Earth orbit based early warning constellation before and has even tested the technology using two STSS satellites, in the end it declined to proceed. “At that point in time the cost of satellite buses were significantly higher than what we see in the curve today” said Laughrey.

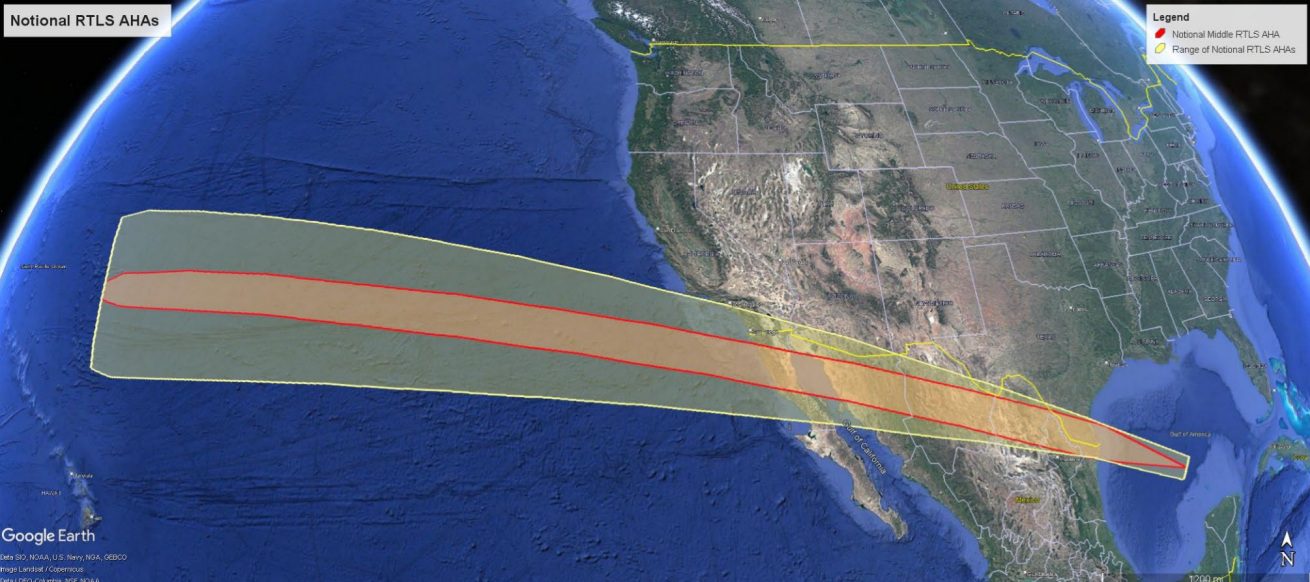

However, now that more nations are acquiring ballistic missiles, and with the new threat of hypersonic cruise missiles, Laughrey is more hopeful that this time a new LEO-based early warning system will be built. He cautioned however that Space Sensing Layer design was not yet set: “There are a number of trades still going on” he added.

Wallis Laughrey had earlier confirmed via a reply to public question at the Rispace conference in London, that hypersonic cruise missiles can be tracked with good sensitivity from low Earth orbit. However, whether this would be via the thermal signatures of the missiles’ airflow friction-heated bodies, their exhaust plumes, or their atmospheric wakes, there are still some technical issues to be solved if these missiles are to be successfully tracked from low Earth orbit. Drawing a parallel in trying to watch a humming bird fly using binoculars, he noted that but that the field of view and field of regard of a satellite-carried sensor would have be large enough and the sensor agile enough to allow a hypersonic cruise missile to be tracked efficiently in its predicted flight direction. “You are trading image quality in the widest area” said Laughrey.

Even without the Space Sensing Layer, Laughrey explained that Raytheon is still well positioned given that there are other military programmes which would also need advanced sensors. For example, DARPA has instituted a programme called “Black Jack” which could add military sensing capability to commercial satellites.

When questioned if civil-use sensors were ever less than state-of-the-art compared to what might be available to military programmes, Laughrey replied that there was no military or civilian bias on technology and that it is up to the customer to define what its sensor requirements are.

Laughrey explained that this was the approach used by commercial satellite operator Digital Globe when they asked Raytheon to build the sensors for its new Legion Earth observation satellite constellation.

“It is always that trade of cost and schedule versus the performance.” said Laughrey, noting that the TRL (Technology Readiness Level) required and its overall cost would be most likely the key drivers of which level of capability was chosen rather than any secrecy issues.

Although Raytheon’s space business is currently very healthy, that does not mean that everything has gone its way. Some scientific missions (including their Raytheon-produced sensors) to monitor the Earth’s environment have been cancelled (DT comment: this was ordered by the Trump Administration although this decision may yet be changed following the result of the Congressional Mid-Term elections). Nevertheless, Raytheon is now looking outside the USA to work with other companies on similar satellite systems abroad. As an example, Laughrey noted that he had been conversation with the Oxfordshire-based Rutherford Appleton Laboratory (RAL) in this respect.

Raytheon remains grateful that ITAR is no longer the issue that it once was, and the export and import of technology to a friendly nation like the UK is not a major problem in Laughrey’s view. With respect to the possibility of the UK military acquiring an image satellite capability from Raytheon, Laughrey confirmed that his firm was “actively engaged in dialogue with the (UK) MOD”.