While improvements to pension freedoms, measures to encourage saving, and the potential for extra-judicial tax raids on bank accounts, stole the headlines about the recent UK Budget presented by UK Chancellor of the Exchequer, the Rt Hon George Osborne MP, a smaller announcement hidden in the small print will be small filip to both space insurers and to UK-based commercial satellite operators such as Inmarsat and Avanti. Secondary legislation will be shortly introduced to exempt Insurance Premium Tax (IPT) from having to be paid for their satellite risks in the Space Insurance class.

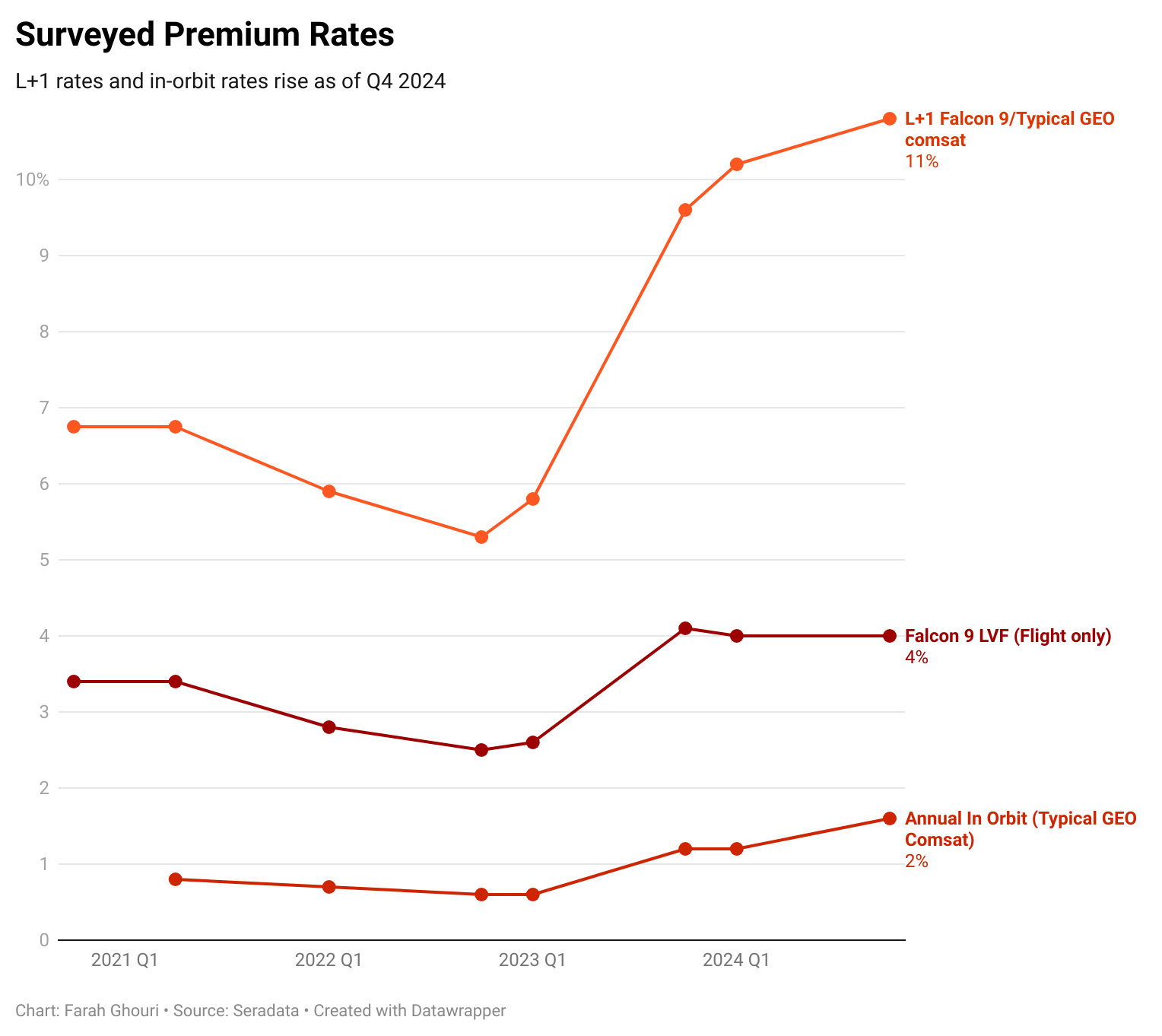

Space IPT in the UK is currently charged at a rate of 6% of the premium paid and is levied on UK-based satellite operators for their satellite and launch risks. This rate represents an mid-rate between those nations which do not impose this tax, and nations like Germany which currently charges satellite IPT at a rate of 19%. Given the small number of operators involved and given that there are loopholes to reduce or remove IPT for the launch phase by registering satellites via subsidiary companies located in lower tax regimes e.g. the Isle of Man, the amount currently raised by IPT for the UK Treasury on satellite risks is a relatively small at only circa US$1 million per annum.

Comment by David Todd: While UK-based satellite operators will be happy that they will be now exempted from paying IPT, in truth the real reason the tax was abolished was that it was viewed by the both UK Treasury and the insurance market as being more trouble than it was worth. The removal of IPT is another example of George (nee Gideon) Osborne, showing himself to be supporter of space and its related service sectors, viewing it as one of the high tech industries that the United Kingdom can genuinely compete in. His previous acts of support have included increasing the overall UK space spend mainly within the European Space Agency, while, at the same time, providing £60 million in funding for the revolutionary research air breathing rocket engine hardware currently being done at the Oxfordshire-based firm Reaction Engines. Osborne has even visited the rocket scientists at the firm and tweeted about their potential technological impact.

The writer of this article holds a small financial interest in Reaction Engines. The previous post of this article incorrectly stated that the IPT rate was 5% (it is 6%) and that IPT was not applicable to most launch risks. This latter statement is only correct because companies avoid UK launch IPT by registering their satellites in the Isle of Man. They do have to pay IPT on post-acceptance in-orbit risks however, as UK-based ground stations are being used to pick up the signals from the satellites concerned.