While other outfits plan new LEO satellite constellations, two of the major constellations already in existence have their own cash flow concerns. However, they are using inventive ways to navigate around the problem. Globalstar Inc has managed to negotiate a deal with Hughes Network Systems, its ground network provider to accept payment in shares rather than cash for its services. The deal involves 95% of a US$16.3 million owed being paid in discounted shares.

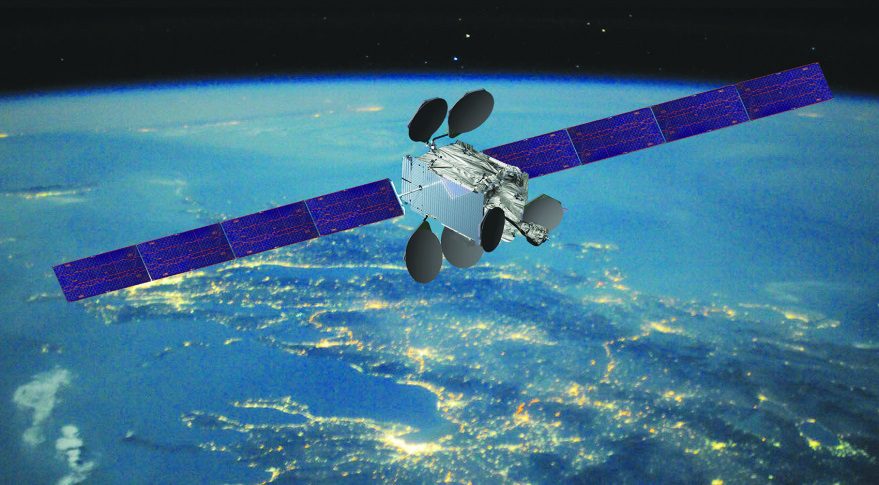

Meantime, Iridium Communications has reportedly approached its financiers including the export credit bank Coface, to give them leave from contractual obligations stipulating that they have to buy launch plus one year in orbit insurance for their new Iridium Next second generation satellite constellation, which given insurance sentiment against untested large constellations, will be priced at very high premiums. For the time being, the firm is counting on its remaining satellites working until next year when the new satellites will start to be launched.

While Iridium has suffered several satellite failures over the years, its constellation’s recent reliability has reportedly been better as it continues to service both voice and business-to-business data markets.

While revenues from Russia have fallen mainly due to the rouble devaluation, the firm’s financial position was recently bolstered by the signing of a new five-year contract worth US$400 million to provided US government and defence personnel with unlimited access to the Iridium Communications network.