The recent announcement that the low Earth orbit communications satellite operator, Iridium, was rolling out a new product called Iridium PRIME had some in the space industry wondering if this was a hosted payload too far as the firm offers what, in effect, will be, a complete rented spacecraft to clients. David Todd was granted a telephone interview with two of Iridium’s executives, Dave Anhalt, vice president and general manager, Iridium PRIME, and David Wigglesworth, vice president, data services, to find out exactly what Iridium is up to.

The past and the present of Iridium

Iridium has a long and convoluted history stretching back to the early 1990s. Stemmed from Iridium’s inability to cope with the fact that even terrestrial mobile and cell phones subsequently had the ability to roam in lots of nations around the world, thereby blunting Iridium phone’s Unique Selling Point (USP), the originally Iridium firm went backrupt. The new Iridium emerged from bankruptcy taking over the valuable satellite assets from the previous bankrupt firm.

In inheriting its valuable space-borne assets, Iridium’s new business plan was still able offer mobile telephone and data communications services across the world – but without the debt burden that the previous Iridium firm was struggling to cope with.

Iridium retained the benefit of having low Earth orbit constellation crossing the poles and by using low- latency inter-satellite links and omnidirectional antennas, it could again offer the world’s only truly global satellite communications system. In doing so, it could offer service to areas and in directions on the globe that Geostationary satellite operators could not reach. This was key to the bring being signed by the US Department of Defense (DoD) provide its servicemen and women access to a mobile communications service carrying voice and data communications.

With over 51,000 US DoD users, the Defence Information Systems Agency (DISA) recently signed an five-year air time contract worth $400 million and committed $39 million for a new military satellite communications “gateway” for Iridium located in Hawaii, to add to Iridium’s civil and commercial gateway in Arizona. “We are the only mobile network with a Type 1 encrypted handset capability.” noted David Wigglesworth.

But it was not just military communications, useful grounding though this was, which has become Iridium’s main business. In fact, military users make up less than 10% of Iridium’s subscriber base which currently stands at 655,000 current billable subscribers. It is in data and more specifically machine-to-machine applications that the firm is seeing the most growth potential.

However to carry on offering such services the firm needs a healthy satellite constellation. The current and original Iridium satellite constellation has now aged well past its satellites’ own design lives. Some have already retired due to failure with one even being wiped out in a collision with an old Russian Cosmos satellite (by the way Iridium takes especial care now over the tracking of collision risks).

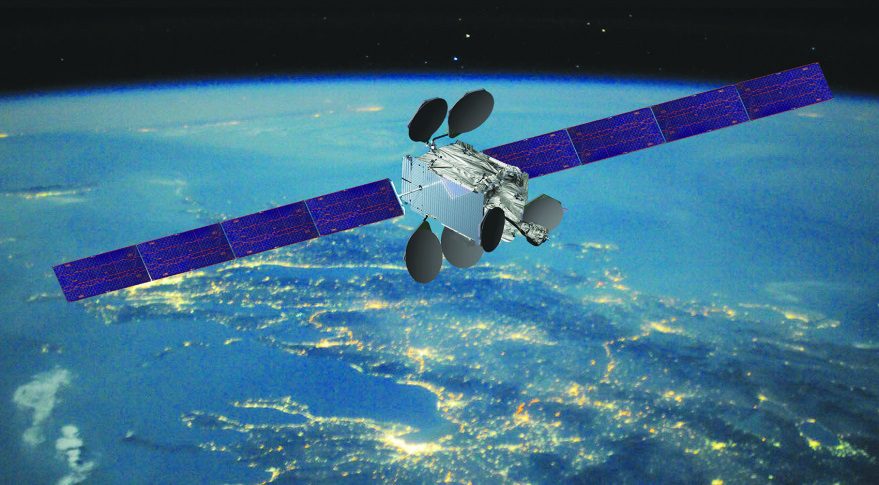

As such, the firm has now started a new satellite replenishment programme which will replace the current 66 satellite plus six spares with a brand new constellation of all new satellites built by Thales Alenia Space called Iridium NEXT.

Iridium plans to start launching its next generation satellites at only two at a time on Ukranian-built Dnepr launches (starting in February 2015) to make sure that there are no serious issues with these, before it later moves on to launching ten spacecraft at a time on SpaceX Falcon 9 launches. As Iridium’s O3B competitor found recently, putting too many spacecraft up in the early days of a new constellation can be an error if a generic fault shows itself.

Even after the main bulk of the constellation has been launch, Iridium retains launch options on Dnepr rockets for constellation replenishment missions.

Iridium eyes maritime and aviation sectors while Machine-to-Machine is already a winner

Iridium has stretched its original core voice and data service to attract business in other sectors and there is acceptance now at Iridium that the data market is actually much more valuable than its original voice communications sector.

Maritime communications which was long been the fiefdom of the likes of Geostationary Earth Orbit satellite operator Inmarsat has been a key target for the firm – at least for the low end of the data rates and bandwidth market concentrating on the voice and e-mail maritime sectors via its 128 kbit/second Pilot system.

Noting the difficulty that its GEO competitors have in getting signals to say Cruise liners in the Norwegian Fjoords, David Wigglesworth, emphasised Iridiums’ communications integrity: “Our solution continues to operate in exactly the same manner where ever it is”.said Wrigglesworth.

Not everything has gone as planned for Iridium’s maritime operation however. The ship-bound “Open Port” system’s “above-deck” hardware needed to access the Iridium system has shown itself to be more fragile than expected and hardware has had to be retrofitted in a repair programme. This has been part of the reason why projections of revenue growth have been cut from 10% to 6%.

Nevertheless, the firm still envisages garnering a significant portion of the marItime and civil aviation market including having a role in the Federal Aviation Administration’s (FAA) Future Air Navigation System (FANS) data link system.

In this and other voice and data applications, Iridium again plays on its relatively good “look angle” capabilities. David Wigglesworth made made especial reference to the problems that other competitor GEO satellite communications systems have with getting their signals though helicopter rotor blades compared to Iridium’s LEO-based service. “With Iridium not only are we closer, we don’t have the issues with look angle” said Wrigglesworth. Iridium also emphasises its utility as a back-up communications service to other satellite systems affected by “dead spots”.

With data rate of only 128kbits per second over its system Wrigglesworth emphasised it was not trying to be the “king of speed,” but pointed out that the L-band communications system was much less susceptible to “rain fade” which can affect other bandwidths such as Ka-band.

While the maritime and aviation sector promises future growth, Wrigglesworth highlighted that it was the firm’s Machine-to-Machine data market sector which has shown the fastest subscriber growth with an annual increase in the 20-30% range over the last few years and now accounts for 40% of Iridium’s subscriber base.

Machine-to-machine applications range from haulage firms tracking their trucks to fisheries protection officers tracking fishing fleets, to firms wanting to monitor domestic and industrial appliance usage.

Iridium NEXT offers hosted payloads – but there are limits

As it planned the financing for Iridium NEXT, Iridum became determined not just to learn from its own mistakes but also to learn from others. As it watched its competitor Globalstar get loan guarantees from the French export credit agency Coface for the production its satellites at Thales Alenia Space, so Iridium realised ‘if you can’t beat ‘em…join ‘em’ and now has the same sort of arrangement with both Coface and with Thales Alenia Space.

And in building these new spacecraft the firm realised that it could also carry host payloads for third parties. Iridium appointed Harris Corporation to market this capability and it managed to sign the Aireon LLC firm which will place Harris-built space-based aircraft surveillance ADS-B payloads on Iridium NEXT satellites

ADS-B (Automatic Dependent Surveillance Broadcast) is an active transmitting system sending location data from an aircraft via a ground station to air traffic control. And where ground stations are not available say in deserts or deep ocean areas, satellites fill in for these communications blind spots with a receiver/data relay application.

Aireon is expected to pay $200 million in hosting fees to Iridium for the integration and launch the ADS-B receiver payloads on each of its Iridium NEXT satellites. Iridium also expects to receive recurring data communications service fees from Aireon of nearly $300 million, or approximately $20 million annually once fully operational, over the life of Iridium NEXT, assuming Aireon continues to successfully expand to a global business.

The ADS-B payload will consume some 50W of the total 650W power generated by the Iridium NEXT platform’s solar arrays. Iridium and Harris Corporation note however that there is room for more “auxiliary component” hosted payloads though the power available would be limited to only few Watts. To date no client for these has been signed. “There are some Auxiliary Component payloads under discussion, It is just that we have not announced them yet.” said Dave Anholt..

Iridium PRIME gives payload clients a full satellite to play with

To counter the power and space limitations on the standard Iridium-NEXT craft, Iridium has come up with the concept of Iridium PRIME. The idea is that a client would get an entire spacecraft and its power supply, yet still have the communications interconnectivity with the rest of the Iridium network. This latter advantage would give a client two way interconnection capability to control the spacecraft.

The Iridium PRIME bus will be derived from the Iridium NEXT satellite design, removing L-Band communications equipment unnecessary for this use, and dramatically expanding the volume, weight, power and data capacity of the satellite vehicle to support a wider variety of payloads for potential customers. Dave Anhalt confirmed that Iridium will still own and operate the Iridium PRIME spacecraft and that Iridium would also be responsible for procuring the launch. Iridium projects a cost saving benefit to clients of 50 percent or more when compared to current stand-alone solutions.

While no clients for Iridium PRIME had been signed so far, Dave Anhalt reassuringly hinted at a pipeline of future sales: “We have many leads” said Anhalt, declining to confirm the exact nature of any enquires.

Nevertheless, Anhalt described the potential missions that such a spacecraft could be employed for. While the size of the spacecraft and with the orbit not being in a Sun-synchronous type might preclude their use as high resolution imaging or radar spacecraft, the service could act data relay system for such satellites.

Similarly, while Anhalt as an ex-USAF Colonel declined to comment a suggestion that electronic intelligence (ELINT) payloads would be a payload for Iridium PRIME he noted that the service could support military missions including sensors for space-based surveillance and missile launch precision tracking and discrimination..

Dave Anhalt also noted that lower resolution optical and other sensor work could be done including weather monitoring payloads could be carried as could high capacity store-forward systems and payloads for the Automatic Identification System (AIS) which are used to monitor ships.

On the civil science applications side however, Anhalt was especially enthusiastic and specifically mentioned that their system would be ideal for launching unused sensors from the now cancelled NPOESS (National Polar-orbiting Operational Environmental Satellite System) spacecraft.

On the question of client priority: would a customer payload have network cross link and bandwidth privileges over Iridium’s own service at peak times – Anhalt was a little vague on this save to note that any client would have full access to the communication system’s cross links and ability to communicate.

It may not grow as fast as it would like but Iridium’s future looks solid

While its recent growth figures have been a little less than expected, Iridium hopes that its new Iridium PRIME offering will help improve their position. Either way, with this and its other innovations, of all the low Earth orbit based communications satellite constellations now in operation, Iridium shows signs that it is the most likely to survive.

This is not least because the world really does need a truly global reach communications system like Iridium – especially when disasters strike… natural or military.