The sale of US satellite operator Maxar Technologies to private equity firm Advent International and minority investor British Columbia Investment Management Corp has been completed.

Formed in 2017, Maxar is a satellite manufacturer and operator with a fleet of imaging satellites. The company’s headquarters are in Colorado although it has over 20 offices and employs more than 4,400 people globally.

Maxar Technologies has ceased to be traded on the New York Stock Exchange as it is now a private company following the buyout. Advent International and British Columbia agreed to pay US$53 per share in cash for Maxar common stock, making the deal worth around US$6.4 billion.

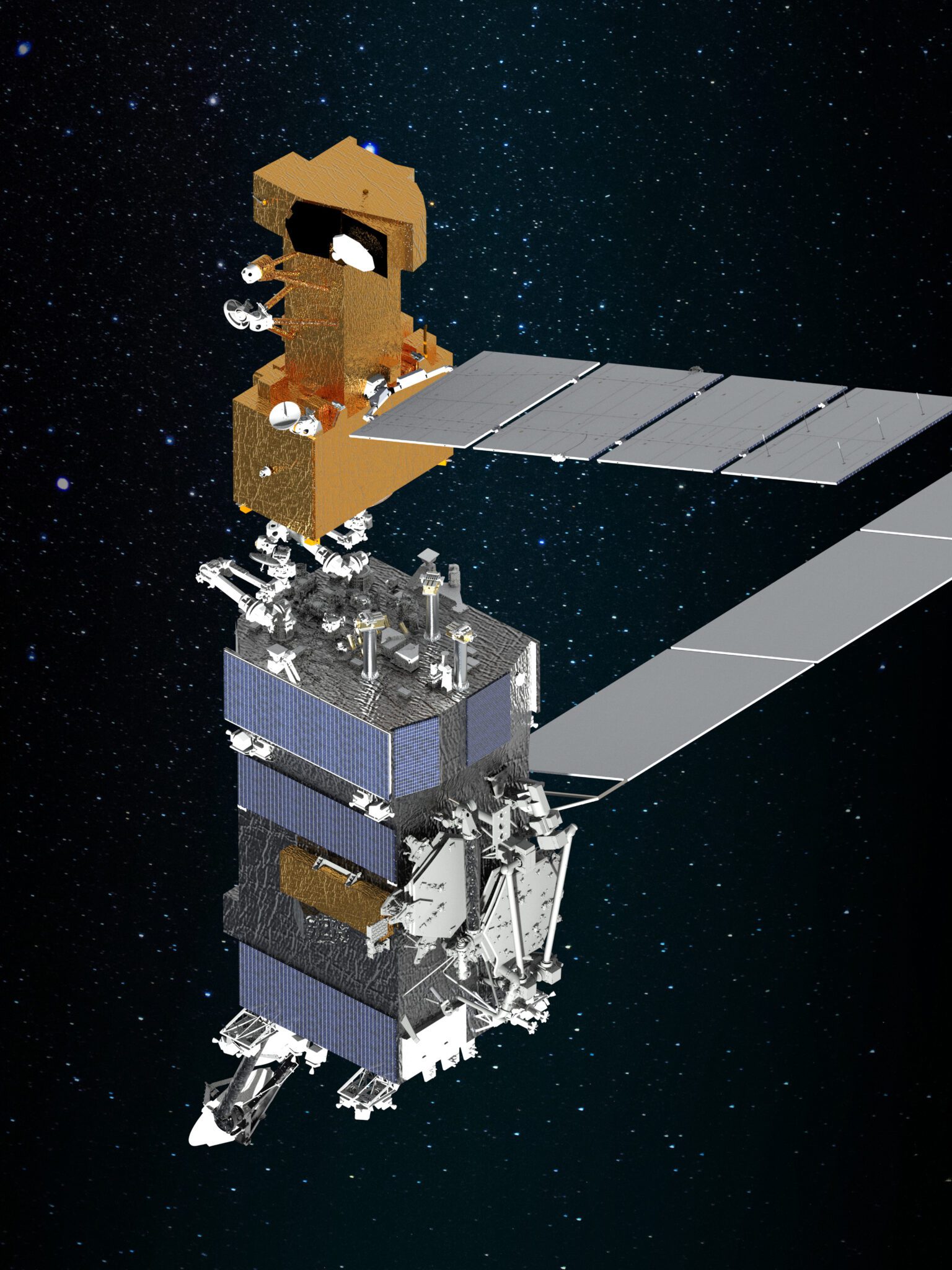

Artistic impression of Maxar’s Tranche 1 tracking layer. Courtesy: Maxar Technologies