Satellite manufacturer and operator Maxar Technologies has been acquired by global private equity investor group Advent International in a US$6.4 billion deal. The all-cash transaction was announced on 16 December.

US-based Advent, which had US$89 billion in assets under management as of September, has agreed to buy all of Maxar’s common stock for US$53.00 per share representing a 129 per cent premium over Maxar’s closing stock price of US$23.10 on 15 December, the last full trading day before the takeover proposal was announced.

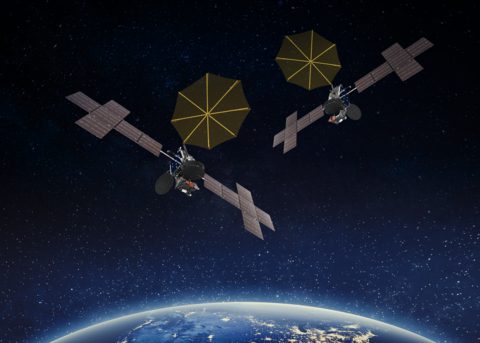

The deal will allow Maxar to accelerate its satellite investments including the delivery of the Legion satellite constellation and the launch of Legion 7 and 8 satellites. President and CEO of Maxar, Daniel Jablonsky, said: “Advent has a proven record of strengthening its portfolio companies and a desire to support Maxar in advancing our long-term strategic objectives. As a private company, we will have enhanced flexibility and additional resources to build on Maxar’s strong foundation, further scale operations and capture the significant opportunities in a rapidly expanding market.”

The global head of Advent’s aerospace and defence team, Shonnel Malani, said: “In our view, Maxar is a uniquely positioned and attractive asset in satellite manufacturing and space-based high-resolution imagery, with an incredible workforce and many opportunities ahead.” Advent already has invested around US$28 billion in the last three years in the defence, security and cybersecurity industries.

An artistic rendering of Maxar’s SXM-11 and SXM-12 satellites for SiriusXM. Courtesy: Maxar

Advent has arranged committed debt and equity financing for the transaction. Funds advised by Advent will make an aggregate equity contribution of $3.1 billion and British Columbia Investment Management Corporation is set to provide a minority equity investment of US$1 billion.

The agreement allows for a 60-day (until 14 February) “go-shop” exercise by the Maxar board, which will see if can solicit a better offer. Maxar shareholders will also need to approve the deal.

Various regulatory approvals are being sought and, assuming clearance, the transaction is expected to close by mid-2023.