Despite improved profitability in the space insurance market after a series of losing or flat years, several long-time space insurers are reported to be heading for the exit. Seradata understands that the Munich-headquartered underwriting firm Allianz has decided to leave the market after a long involvement via its French operation. The company operated with a medium-size US$15 million capacity line. Allianz has not responded to a request to confirm or comment on the report.

Earlier this year Bermuda-based Aspen Re decided to leave both aviation and space, which were mainly handled by its London office. Aspen Re, via its US$20-25 million of available capacity (the amount of insurance available to insure a specific space risk – launch or in orbit), was mainly a supporter via its participation in insurance consortia and its reinsurance activities. Its decision to leave was thought to be driven more by its related aviation exposure, which is likely to suffer large losses on aircraft confiscated by Russia in retaliation for Western sanctions following its invasion of Ukraine.

Given that overall market capacity is circa US$650-700 million, these combined defections are not insignificant and underline the trend of major and long-term players deciding to leave the space class.

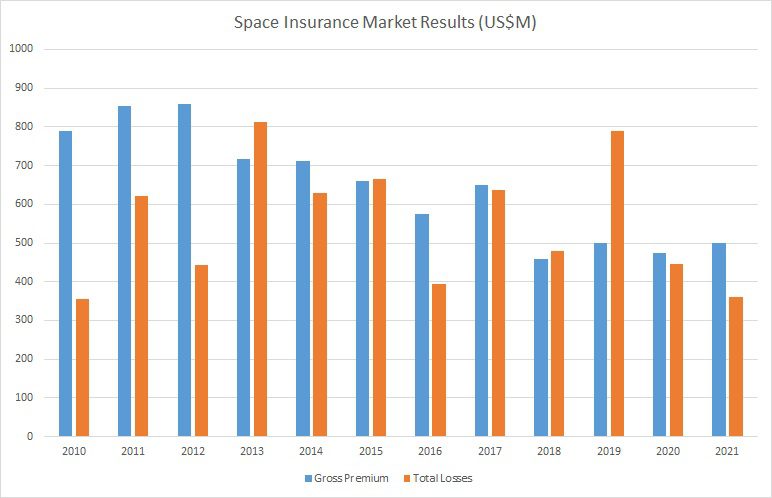

The first major player to go was Swiss Re in 2019. This was followed by industry giant AIG in 2020. They had become exasperated by the low rates in this volatile class, in which a single loss can decide whether a year is a winning or losing one.

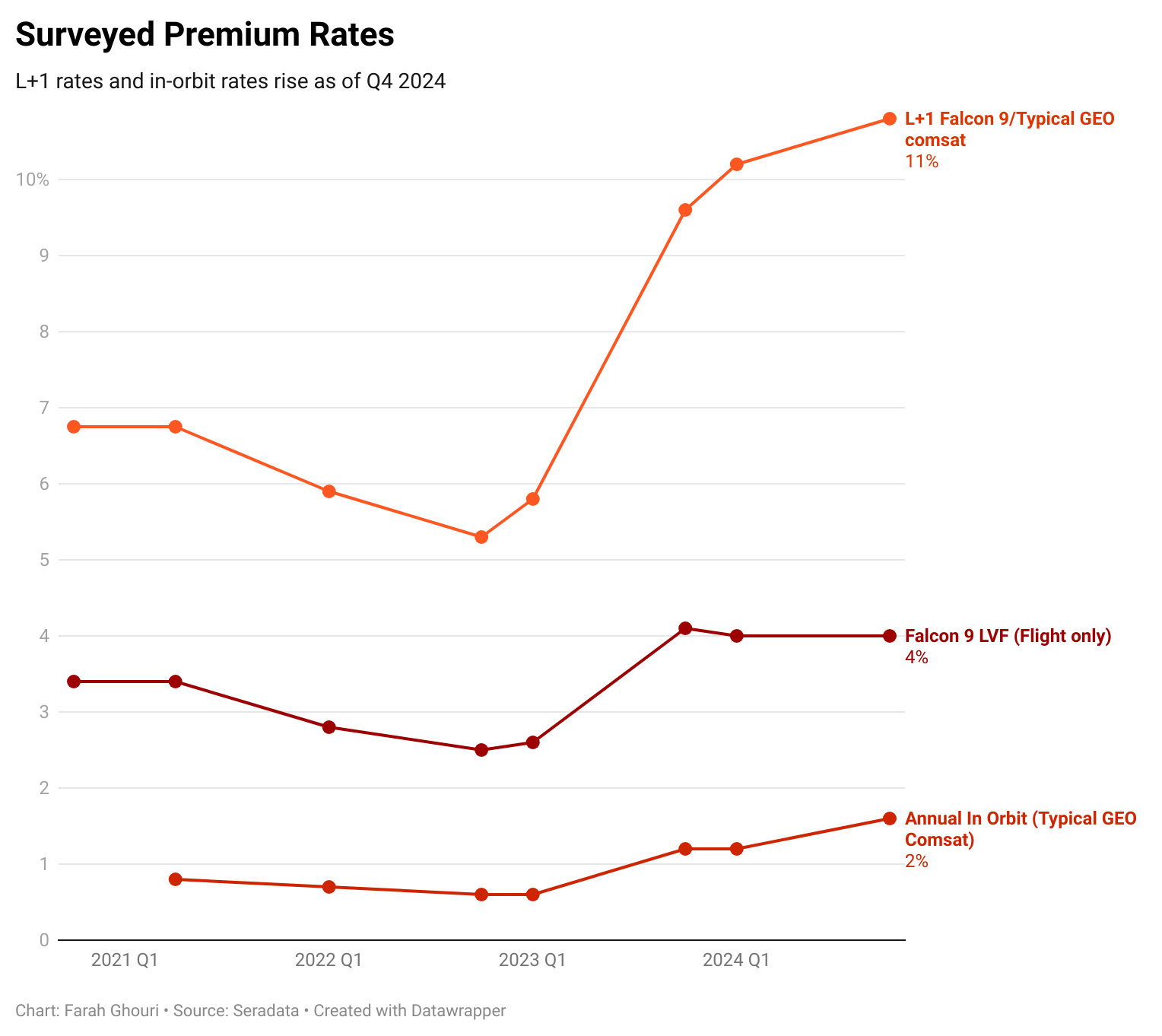

Low premiums have been partly caused by inexpert newcomers driving down rates. Broker power has also contributed via the “vertical marketing” system – a sort of blind auction whereby each underwriting firm quotes a rate for a risk not knowing what others have bid. An additional concern is that while the space industry has been expanding rapidly, the growth is mainly in the LEO sector of large constellations that have enough reserve capacity not to need to insure – at least for in-orbit cover.

Others predict that some large losses are likely to hit the market as new rockets begin operations. Maiden and early flights of launch vehicles traditionally have teething troubles which result in losses – sometimes insured.

Premium rates spiked after the poor result of 2019, in which a major factor was the US$414.7 million loss of the insured Vega launch of military reconnaissance satellite Falcon Eye 1 for the United Arab Emirates. However, these rates have since fallen back, partly following last year’s profits but also driven by the need to secure top-line revenue from other sources after the loss of Russian premiums.

Agreeing claims can be complicated – especially for those in orbit. An ongoing dispute exists between underwriters and the satellite operator over a claim made about the apparent premature depletion of propellant on MEASAT 3 in 2021 (insurance written in 2020), with speculation that this may have to be solved in a court of arbitration.

CORRECTION: In an earlier edition of this story Seradata reported that Dale Underwriting had withdrawn from the Space class of insurance. This is incorrect. We apologise for this error.

Comment by David Todd: The loss of old players from a market is a sign that all is not well. Something must be done. But what? Vertical marketing may have replaced previous practices, but it has to be made more transparent to achieve the truly open competitive environment it promised. As it is, while the former “lead and following” market will never return formally, it does exist in an unofficial way. Experienced insurers often find themselves doing most of the technical analysis of a risk, only to be outbid by less able underwriters in their chase for premium. There needs to an incentive for these “expert” underwriters if they are not to leave the market altogether. Without these measures, the market will never be consistently profitable and will eventually fail.

Post Script: Long time space insurance underwriter Tim Wright has “crossed the floor” from underwriting to broking (he was formerly at Nexus Underwriting which acquired Tim’s co-founded firm Altitude Risk Partners in 2018). He joins the aerospace arm of the insurance broker Gallagher. Wright joins a team already successful in acquiring new space insurance business. Gallagher already has major accounts with Arabsat, Intelsat and Virgin Orbit. Meanwhile, in a separate development, the space underwriter AXA XL is working with the tracking and software firm LeoLabs to produce a space debris risk assessment tool for space insurers. It uses the ESA MASTER model of debris density to work out the chance of collision/conjunction with debris and micrometeoroid objects too small to track properly. Note: Seradata’s SpaceTrak database has an equivalent basic conjunction risk assessment system which is based on the similar NASA ORDEM model of space debris. The risk expressed as a conjunction risk per year per square metre.