Matthew Wilson, Seradata Reporter and Data Manager, reports from the Satellite 2024 conference in Washington, US, starting with the opening day keynote made by Intelsat’s CEO David Wajsgras

David Wajsgras, CEO of Intelsat, began his address with a reminder of the US company’s 60-year history since its foundation in 1964, including its privatisation in 2001 and the acquisition of Panamsat in 2006. Some of the unhappier moments were also referenced, such as its increasing debt and subsequent fall into Chapter 11 bankruptcy protection in 2020.

However, the company’s fortunes have since improved. It emerged from Chapter 11 two years ago and Wajsgras revealed that Intelsat had made a good dent in its debt pile. At the end of 2023 its debt stood at around US$3 billion, down from the roughly US$6 billion it began the year with. He pointed out that this, coupled with US$1.2 billion cash in hand, meant that Intelsat’s balance sheet was in the best shape it had been in for years.

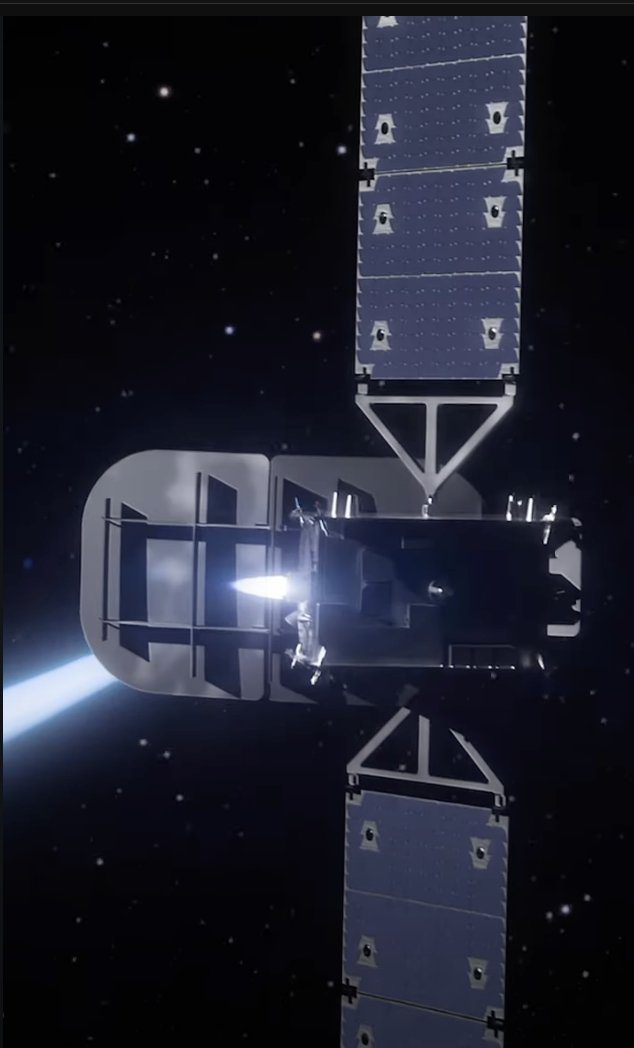

Looking to the company’s future, Wajsgras underlined its new multi-orbit product offering. He went so far as to claim that Intelsat was the only communications satellite operator that could boast of this (MW comment: SES and Eutelsat may dispute this). The multi-orbit product was made possible through the connection, by historical agreements, of Intelsat’s nearly 50-strong GEO satellite fleet and the OneWeb low Earth orbit (LEO) constellation. The latter is part of the new Eutelsat Group, a friendly competitor of Intelsat.

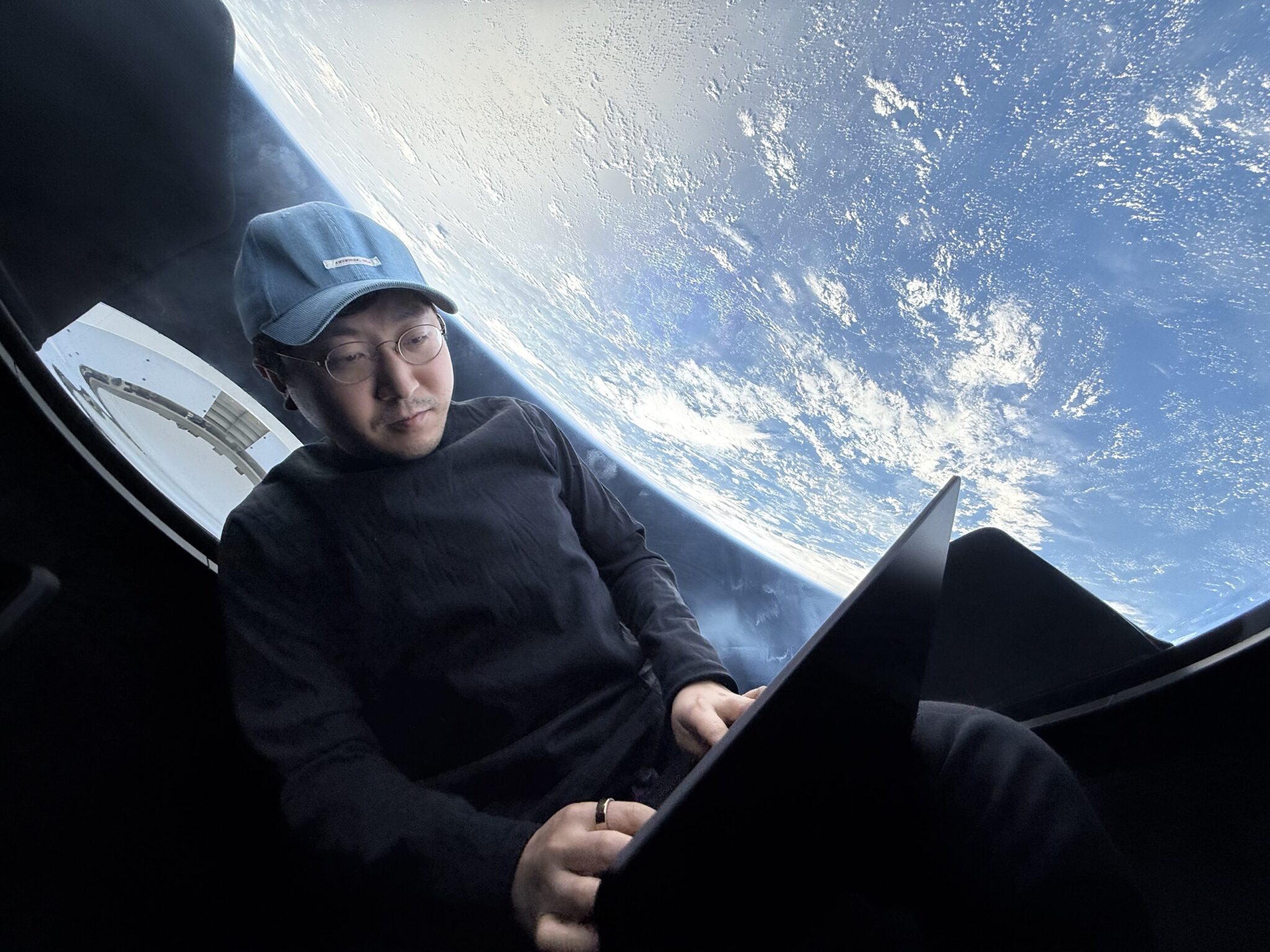

David Wajsgras being interviewed by Rachel Jewett at SATELLITE 2024. Courtesy: Slingshot Aerospace/Matthew Wilson

In a conspiratorial tone, Wajsgras revealed to his audience that Intelsat would soon decide whether or not to develop a medium Earth orbit (MEO) fleet, with a final resolution expected by the end of the second quarter. He emphasised that while the potential programme was in no way certain, it had already garnered strong interest from US Government/civil agencies. (MW comment: Intelsat making a move into MEO space would be a significant development, as this orbit has traditionally been the realm of national GNSS spacecraft and Intelsat’s other friendly competitor SES, through its acquired O3b fleet. Such a programme would require a large investment from Intelsat and would be a valuable win for the satellite manufacturer selected to build it.)

Intelsat CEO David Wajsgras at SATELLITE 2024 Courtesy: Seradata/Matthew Wilson

The revelation of this potential MEO expansion was not enough for Wajsgras, who teased that Intelsat was just “months away” from investing in a D2D (Direct-to-Device) company that has already secured agreements with multiple mobile network operators (MNOs). With this investment Intelsat hopes to use its spectrum holdings to enhance the development of possible D2D products and equipment. It is worth noting that there are only two major D2D players currently in the market: Lynk Global and AST SpaceMobile.

With around US$1.2 billion cash behind Intelsat, and his belief that further consolidation among comms satellite operators is likely, Wajsgras expects an interesting year, to say the least, for both the company and the space industry.