Seradata hosted its biennial space insurance conference virtually this year with over 170 attendees during the afternoons of 23 and 24 June. It was sponsored by ExoAnalytic, Piiq Risk Partners, Aon ISB, and Russell Group. The conference was ably chaired by Morten Pahle the Managing Director of Aesir, of the Volante Group.

Morten Phale and Maurizio Vanotti at the Seradata Space Conference 2021. Courtesy of Seradata

Keynote: Maurizio Vanotti of OneWeb

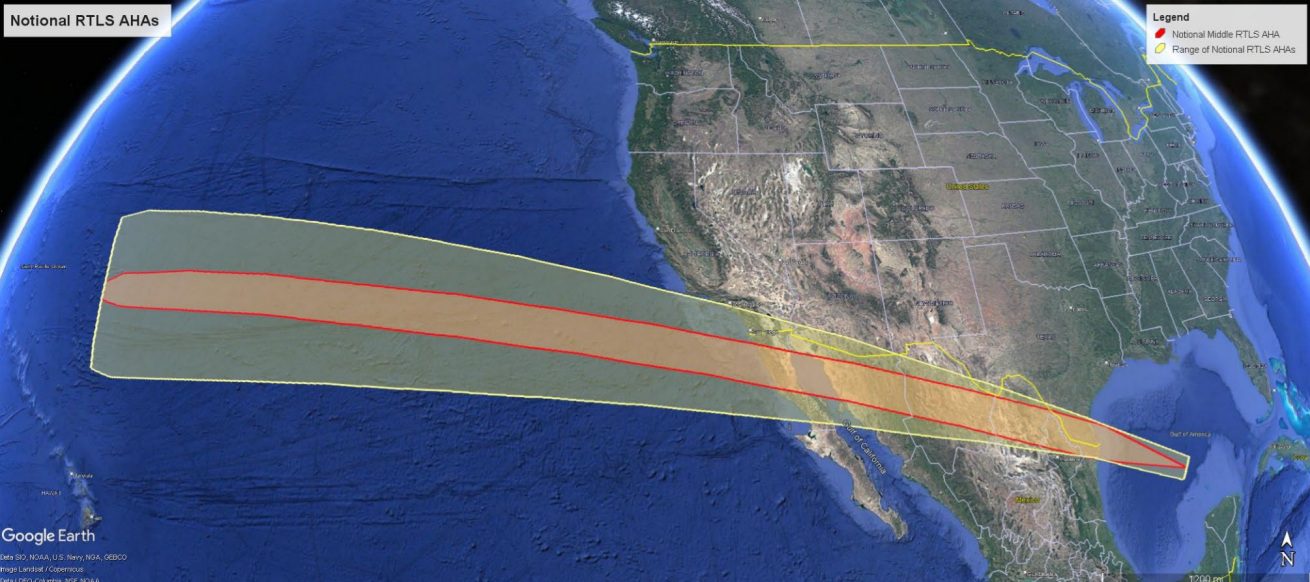

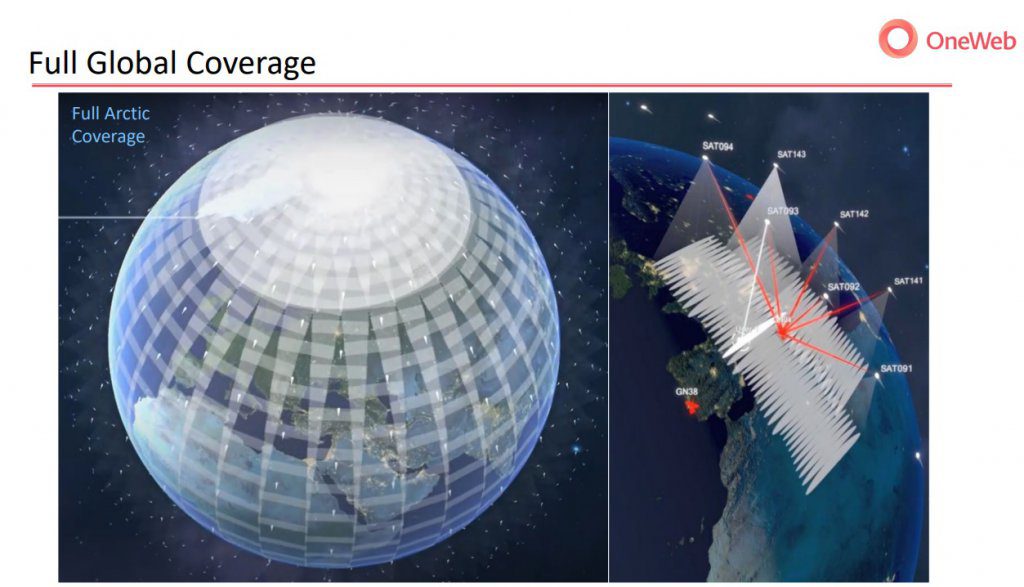

The first day commenced with keynote speaker Maurizio Vanotti, Senior Director at OneWeb, who described the architecture of the system and its future plans. The OneWeb constellation is based in a near-polar orbit at 88 degrees. This enables global Ku-band service with a latency of under 50 ms, about 10x less than that of GEO satellites. The current plan sees it being able to provide a global service by end of 2022 however, the near-term goal is service above 50 degrees North which it intends to be available by the end of this year.

An image of the future OneWeb constellation. Courtesy of OneWeb

In addition to satellite broadband service, the firm eventually plans to offer a Ku-band based global navigation system service involving Position, Navigation and Timing (PNT). However, this planned service will not appear until its planned second-generation of satellites not expected until after 2025. He did state though that they plan to start testing a Timing service on its first-gen satellites. Mr Vanotti noted that whilst it was contracted with Arianespace for Soyuz launches for the current generation of satellites, the company would consider contracting with other providers for its future satellites. This includes small launch providers who may be able to provide a “surgical” service involving one or two satellites to specific orbital destinations.

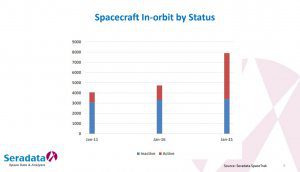

A look at the difference between active and inactive in-orbit units in previous years. Courtesy of Seradata

Immediately following, Tim Fuller the Managing Director of Seradata gave a presentation on recent spaceflight developments and new launchers. He noted the rapid rise in not just the number of satellites but specifically the number of “active” satellites currently in-orbit. Fuller also reported the difference in reliability between large launch vehicles which have a good record and the new batch of smaller rockets which are showing a high number of failures due to their immaturity.

First Session – Space Environment

Moderating this session was Stuart Eves a Director at SJE Space Ltd. He would also be conducting the second presentation of this session.

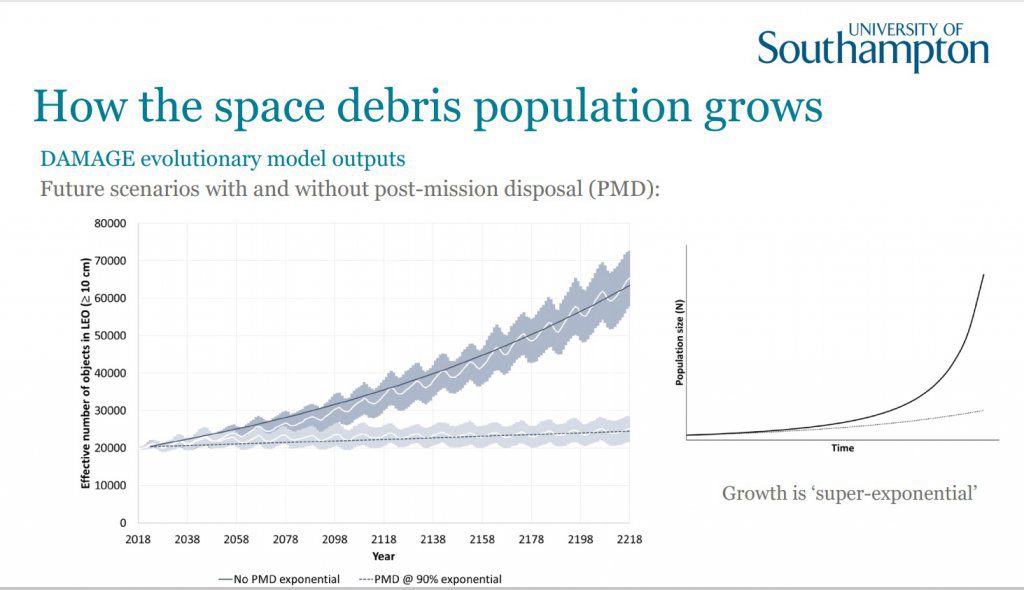

The first presentation was given by Prof Hugh Lewis at the University of Southampton. He noted how the tracked in-orbit population had risen from 8,998 in 2001 to 16,625 in 2011 and to 23,364 in 2021. Specifically, he identified that since 2006 the rate of new objects entering orbit has increased by approximately 50 per cent, greatly outpacing the rate at which objects have re-entered the atmosphere. In fact, this rate has even decreased over the same period. Accordingly, there has been a dramatic rise in sub-1 km near-misses recorded, an exponential increase. Lewis plotted a graph which showed that LEO population growth wasn’t just exponential but “super exponential“. He explained that operators and the authorities must work hard to reduce the debris ‘R’ rate (object multiplication die to fragmentation) and finished by saying that at current levels of population mitigation would result in a doubling of the orbital population in 13.3 years!

A graph from Prof Lewis’ presentation projecting the rapid increase in LEO pop growth. Courtesy of University of Southampton

During his presentation Stuart Eves explained that there had been an increase in deliberate jamming actions of GPS signals. Aside from the direct effects associated with thism he commented on the collateral damage experienced by services which utilises GNSS signals for weather forecasting or scientific research. He also noted that unintentional interference in LEO will potentially become a significant problem whether this is RF or visual. Specifically, he talked about the interference with GEO signals from the mega constellations Starlink and Kuiper and to a lesser extent OneWeb and discussed their planned methods of interference avoidance.

The CEO and co-founder of Slingshot Aerospace, Melanie Strickland, underlined the points made earlier about space debris and noted that there had been an exponential growth in satellite launches and deliveries to orbit. She also reported that without proper enforcement “aggressive behaviour” by space actors had led to the orbital environment becoming the new “Wild Wild West”. Introducing Slingshot she explained that the collation of several sources of data, with data validation could help make decisions on orbital movements more certain and that machine learning could assist.

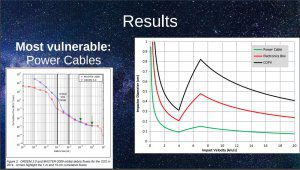

Power cables, perhaps a more at risk component than thought?. Courtesy of Neil Fleming

Neil Fleming a former underwriter at AIG, explained that with respect to debris strikes “the thing that drives the risk is the minimum size particle (debris) which does the damage. The issue with small debris is that it is not tracked. However, he explained that the risk of such untracked debris strikes could be worked out by modelling tracked debris as a proxy. He also noted that conjunction risk varies by orbital altitude, inclination. and eccentricity, with some altitudes and inclinations much dirtier than others. Especially interesting was when he noted that it was not propellant tanks that were most at risk during debris strikes, but rather the relatively unprotected power cables. According to Fleming these are especially prone to short circuits following strikes from debris, fragments may strip the insulation off them and form a “conductive cloud” that facilitates dangerous arcing.

Second Session – Preparing a Smallsat Mission

The second session was moderated by conference chair Morten Pahle. The first presentation was given by Doug Liddle CEO of In-Space Missions. In it he argued that instead of buying a tailored spacecraft it can be cheaper to just buy a payload and utilise spacecraft payload hosting services. He recognised this method may not always exactly meet customer requirements but, new uploadable/reprogrammable payloads may potentially solve such customer concerns. An example is an extremely wideband payload that can be reprogrammed to specific frequencies within a band and tailored to customer requirements. In the future it may even be possible to change band.

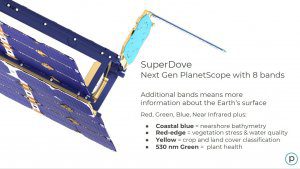

The improved capabilities of the SuperDove platform. Courtesy of Planet

The VP of Launch & Regulatory Affairs at Planet, Mike Safyan, began by noting that his firm operated the largest LEO Earth Observation constellation with over 200 active satellites. Safyan described how the move from the older Dove bus design to its larger SuperDove platform allows for better imaging products through a greater number of spectral bands. Additionally, that Dove constellation is capable of a medium 3.9 metre resolution but the acquisition of the SkySat satellites from SkyBox gave Planet access to 0.5 metre imagery. To help achieve this, the orbit employed was slightly reduced from 500 km to 450 km.

The company is doing its bit for the environment through its involvement in the Carbon Mapper project which intends to launch satellites to monitor methane emissions – a much more potent greenhouse gas than carbon dioxide. Planet will be providing construction and operation services to this project. Safyan made the point that large constellations were always likely to use large rockets and rideshare services with are up to 5x cheaper than a dedicated small launch.

Andrew Strain the CTO at AAC Clyde Space explained the process of satellite procurement and construction right through to launch and operations. His firm is involved in the construction of whole spacecraft, components, and increasingly satellite data. He explained that AAC Clyde Space can supply and/or assist a range of potential customers starting from physical subsystems through to those wanting mission or data services.

The representative of the UK Space Agency (UKSA) Steve Plant reported that the UK Government is in the process of passing secondary legislation concerning launch insurance and third-party liability (TPL). Additionally, this will see the transfer of regulatory authority to the Commercial Aviation Authority (CAA). Plant reminded the audience of the UK’s commitment to reduce space debris. With respect to TPL the UK is following the US towards a Modelled Insurance Requirement (MIR) approach for calculating launch TPL requirements. Concerning orbital liability, he reminded the audience that EUR€60 million of cover was needed for satellites operating in orbit, but that a waiver was available for propulsive spacecraft headed to LEO below the ISS. He also warned satellites involved in proximity missions may also need further cover.

A Slide outlining a proposed mutual insurance fund for smallsat operators. Courtesy of Alden Legal

Joanne Wheeler a Managing Partner at Alden Legal, explained that UK TPL was often too expensive for first-time operators of small satellites. One way around this however, was the possibility that small satellite operators could establish a mutual insurance fund. This she argues could be an ideal solution and one that has precedent in other sectors accepted by the UK Government. Wheeler stated that some countries and companies may be “evading their responsibilities” in terms of liability. Examples of this is “forum shopping” where companies shop around for a licensing regime that offers less restrictive (and cheaper) regulations.

Day 2

Keynote: Tory Bruno of ULA

After a Seradata morning training session for the SpaceTrak database. Keynote speaker Tory Bruno, CEO of ULA, noted that his company specialises in the most “complex orbital insertions”. ULA intends to introduce a greatly improved and “reusable in space” upper-stage, Centaur V, on its upcoming rocket the Vulcan. As he surveyed the launch market there was a surfeit of launch capability “many countries see access to space as a sovereign capability”.

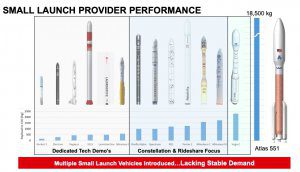

A range of performances from the small launcher population. Courtesy of ULA

With capacity chasing too few missions, prices are likely to trend downwards he remarked, “It is unlikely we’ll ever have an under-supply of launch, which means that it is likely we will always continue to have downward pressure on launch prices.”

Bruno seemed to underline Mike Safyan’s earlier comments about large-scale launch costs noting that constellations like to use larger rockets. But that there may be a role for smaller vehicles to replace individual satellites in fleets, even if most constellations are insensitive to the loss of a single unit. Nevertheless, he warned that in his view the market would only allow 2-3 small rockets to exist. While constellations now count for 80 per cent of active satellites in LEO there were some issues in launching them. He warned that the Starlink constellation has made it difficult to launch to immediately adjacent orbits. Read more about this here.

The ULA CEO who has so far avoided the fate of the Knights Templar Grandmaster. Courtesy of ULA

Bruno amused the audience with his comment that his business strategy aimed at countering more disruptive competitors (read SpaceX), was based on doing the opposite of the Medieval Knights Templar, who found themselves in a similar position. As a student of the history of the Knights Templar he spoke about a more personal goal of avoiding the fate of the Grandmaster of the order, being burnt at the stake!

Finally, with respect to reusability Tory Bruno eschews full stage recovery in favour of simply recovering the first-stage engines. This approach they have determined offers the best financial benefit without the performance penalties associated with full-stage fly back.

Third Session – Bus Technology

The third session was moderated by Xavier Ibos a Marketing Manager at Airbus Defence & Space. He was first joined by Philippe Francken VP of Risk Management at SES.

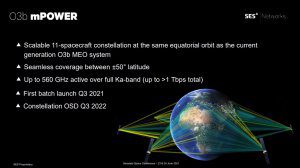

An overview of the upcoming MPOWER fleet. Courtesy of SES

Francken talked about the new O3B mPower constellation, which is planned for launch later this year, and will offer 560 GHz of capacity and 1 Tbps of throughput in Ka-band. These new satellites will slip into the same orbit as their older O3b predecessors in MEO. More technically he described how the user return bandwidth for communication satellite payloads has become more important. Supporting this was an example of a reconnaissance aircraft relaying its data back to base. After briefly mentioning digital payloads and active phased-arrays he spoke about the SES Adaptive Resource Control (ARC) suite. This will enable greater real-time coordination, distribution of capacity, and the integration of the MEO/GEO networks which is the unique SES asset.

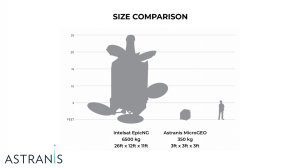

Comparison between a normal GEO satellite and the Astranis MicroGEO. Courtesy of Astranis

Joining from the US West Coast and representing Astranis was Christian Keil the Chief of Staff. His presentation informed us of the Astranis business case that, big isn’t always beautiful. He went on to explain the concept of the 350 kg Astranis MicroGEO platform designed to make GEO services cheaper and easier. Through its small GEO satellite Astranis is hoping to attract small to medium countries as customers and to enable them to gain capacity over specific geographic areas. Its initial mission will cover the often over-looked and under-served US region of Alaska.

Chris Brunskill at D-Orbit introduced the ION Satellite Carrier. D-Orbit provides last-mile delivery solutions for smallsats hoping to reach orbit. At the time of conference, the ION vehicle had flown twice, with its third mission on the SpaceX rideshare expected by the end of June. He told us of future plans to expand the company’s reach into the in-orbit servicing, life extension, and end-of-life service markets.

Ane Aanesland, ThrustMe, a small spacecraft propulsion company is working on solid Iodine as alternative to traditional electric thrusters. She explained that using iodine had cost advantages over more traditional fuels such as Xenon and Krypton. It cost just two per cent that of Xenon and is nine times denser than Krypton, plus there is no requirement for pressurised loading.

Fourth Session – Insurance Panel

This year’s insurance panel differed from those of the past through a distinct lack of space insurers and brokers. Instead, it was decided to hear from alternative viewpoints concerning insurance. Charged with moderating this panel was Liam Martin the Managing Director of Bant.

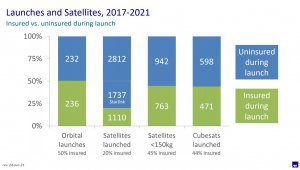

A look at the number of satellites insured at launch over recent years. Courtesy of AXA XL

Chris Kunstadter of AxaXL described the insurance market and the pressures that it is under. Launches of satellites have been delayed by the global pandemic and construction has suffered from supply chain issues. One surprising factor that he pointed out was the lack of available Gallium-Arsenide solar cells. While SpaceX’s Starlink launches have had a major effect on the global launch cadence, he reported that only 20 per cent of satellites are insured once in-orbit, whereas in the classic GEO market about half the satellites are insured. Nevertheless, the grand total of all satellites insured in-orbit is US$25.9 billion. Meanwhile, the market still needs US$600 – US$800 million capital to cover the largest risks.

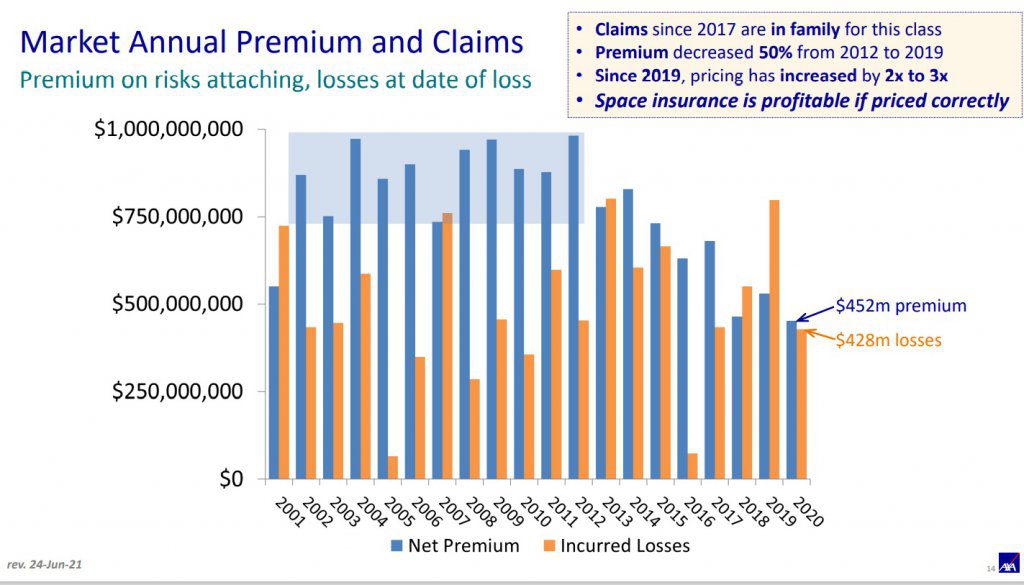

He stated that while 2020 was technically profitable, it was only just so, and he was concerned about the lack of profitability of the market. A final point was made about the ageing population of GEO satellites, many of which are operating beyond their design lives. [*Seradata’s David Todd comments that once other costs were included, the insurance market as whole likely made a loss.]

An analysis of profitability of the space insurance market over the last 20 years. Courtesy of AXA XL

Sarah Parker of In-Space Missions (formerly Managing Director of SSTL) noted that small operators wanted long-term insurance cover. Echoing presentations given previously by Steve Planet and Joanne Wheeler, she noted how new forms of TPL were required for newspace companies owing to the disproportionate costs of TPL premiums compared to the value of many small satellites. She was very positive about Plant’s report of changing regulations in the UK and Wheeler’s proposed smallsat mutual insurance fund.

Liam Martin and Sydonie Williams talking after her presentation. Courtesy of Seradata

Cyber insurance specialist Sydonie Williams at Beazley explained that cyber insurance did not regularly cover physical damage, thus any actual damage to a satellite caused by a cyber attack would be uninsured. Williams also frightened the conference by noting the growth of ransomware and cyber extortion. Which she claimed was close to being greater than the illegal drugs trade. While difficult to believe nevertheless, it is indicative of how dangerous this has become. A final shocking point noted how these organised crime entities also had professional customer support systems and help desks!

Neil Roberts, of the Lloyd’s Market Association (LMA) provided the conference with an alternative viewpoint from the world of Marine insurance. He talked about the work of committees (including the “sub-” and “joint-” flavours) there in the formation of policy wording reference documents. An additional point focussed on was competition law and the consequences of breaching it for both the company and individual. He stated that company’s risked fines of up to 10 per cent of global turnover.

Fifth Session – The Future

This final session was moderated by Denis Bensoussan, Head of Space at Beazley. Who briefly introduced some of the technologies, and the risks associated with them, that are coming over the horizon for the space industry.

Dennis Wingo of SkyCorp, having previously worked with the technology behind the Northrop Grumman Mission Extension Vehicle (MEV) introduced us to what he believes to be the next step in its evolution, the Orbital Logistics Vehicle (OLV). A satellite with modular components and payloads. To describe this SkyCorp has invented a word, “Reprovisionable” to describe its ability to have a payload changed out for new one during the spacecraft’s lifetime. He suggested that repurposing satellites in-orbit reduced their lifetime cost by 80 per cent.

Astroscale’s current and future plans as it seeks to commercialise debris removal. Courtesy of Astroscale.

The Head of Business Analysis at Astroscale, Harriet Brettle, talked about her company’s intentions to commercialise debris removal and “end-of-life” services. At present its debris removal demonstrator spacecraft, ELSA-d, is in-orbit and this summer the company intends to begin its debris capture demonstrations. Once this spacecraft has completed its demonstration programme will be de-orbited. Astroscale is also working on a satellite end-of-life demonstrator called ELSA-M which it hopes to launch in the coming years. This is being developed in collaboration with ESA, the UKSA, and OneWeb.

Ariane Cornell, of Blue Origin, in her role of Director of Astronaut and Orbital Sales brought us up to speed around the planned 20 July crewed New Shepard mission which will carry Jeff Bezos, his brother, and two unidentified passengers. Whilst doing so Cornell also outlined the healthy flight record of the New Shepard rocket and capsule over its 15 test-flights. One of the anonymous passengers recently won their seat with an US$28m bid hosted by Blue Origin. In answering a question from Seradata’s Todd about whether Blue Origin would have flown SpaceX’s Elon Musk if he had bid, Cornell deftly stated that they would be “happy to fly as many people as possible into space.”

(Update on 12 July: Elon Musk subsequently booked a suborbital ride with Blue Origin’s competitor Virgin Galactic.)

The large windows of the New Shepard capsule. Courtesy of Blue Origin

Closing Remarks

David Todd, Head of Space content at Seradata, gave us the answers to the conference space quiz. The quiz covered topics from Space history to Rocket science. But one of the questions involved him revealing that he had once exchanged comments on love poetry (via email) with SpaceX founder Elon Musk. A fact that the quiz winner apparently knew sincehe scored 100 per cent. As it was most participants who attempted the quiz maanged to achieve a 15/20 score, “making them true space cadets” in the words of Mr Todd himself.

Morten Pahle rounded up the conference with a nice summary of some of the main points from our presenters and gave thanks to the attendees and organisers.

Article written in collaboration between Matt Wilson and David Todd.