At the Seradata Space Conference in London on 9 June 2015, this writer (David Todd) gave a brief presentation noting that launch reliability had remained relatively stable, and from Seradata’s serious anomaly dataset, that in orbit reliability was slowly improving – albeit with the elephant in the room that Russian-technology induced losses were holding back further progress. Some 70% of the insurance losses by value since 1 January 2014 have Russian technology/quality control as being implicated as the cause.

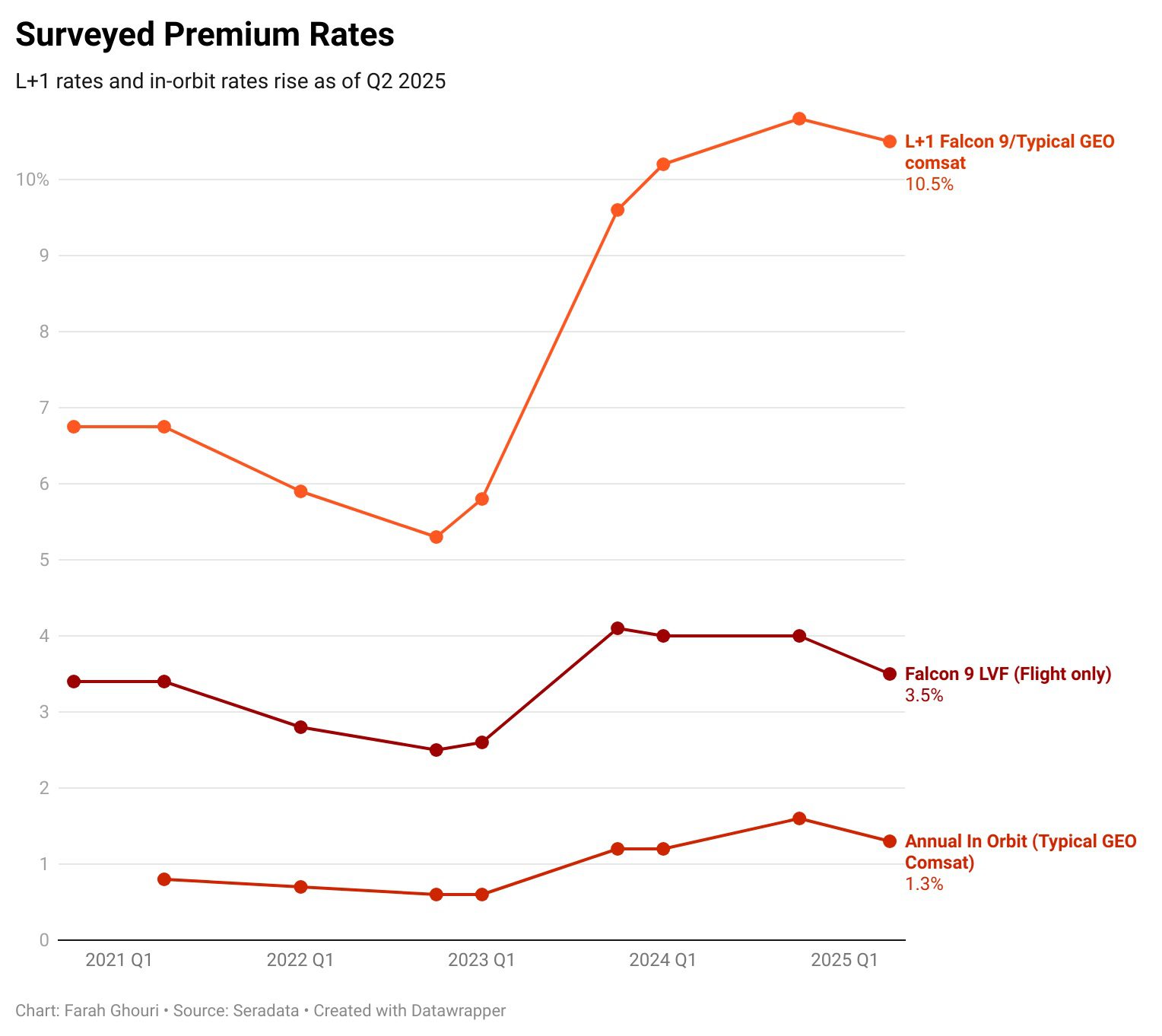

As the chart above, provided by XL Group shows, premium rates are falling. They are now close to and, in some cases, below the break even rate due to overcapacity. As such space insurance is now no longer profitable with a net market loss in 2013, near loss in 2014, and with a net market loss likely in 2015. As market losses grow, the prediction is that capacity will fall and that premium rates will eventually rise again.

The session then moved into a series of questions put to a panel of underwriters versus brokers/operators for comment on other aspects of the market. Each question/topic would have a final verdict delivered by audience vote.

The first question was about launch plus multi-year policies and whether they were good for the market. Manja Prommel, a space underwriter at Munich Re made the point that many operators wanted such policies which Munich Re helped reintroduce and that they were not necessarily bad, despite past market experience, so long as the rate could be judged properly. She affirmed that Munich Re had the data and expertise to do this.

The brokers and operators (and their financiers) were broadly in support of her, although Peter Elson of JLT noted that the expense of such policies was sometimes too much for operators to pay for at the start of their operations. Other insurers remained sceptical including Pascal Lecointe, space underwriter at Hiscox. The vote went his way, with the majority of the conference saying that launch plus multi-year policies were not a good idea.

On the question of whether “vertical marketing” (with every insurer getting its own individual rate instead of a single rate being set by a lead underwriter) was good for the market, all spoke in support of the competition it gave and how the insured usually benefited. Senior Vice President at the broker Marsh, Simon Davies, pointed out that this had also caused more of the insured clients to be much more actively involved in the insurance process. While there are reservations over the transparency of the process (only the broker knows exactly what each rate each underwriter is getting), the conference vote went almost unanimously in favour of “vertical marketing”.

A later question about whether “quality capacity” should get better (higher) rates was passed by the conference, though the problem with this is partly of definition (presumably brokers define “quality capacity” as that which pays its claims when required) and partly that every underwriter thinks they and their capacity is “high quality”. Peter Elson, head of Space at the broker JLT did his bit for tongue-in-cheek sycophancy by wryly stating that he regarded all three underwriters on the panel as being “quality capacity”.

On the question about whether satellite reliability had improved, Pascal Lecointe noted it probably had though more especially after the first year in orbit. However he said that the trend was not conclusive. David Shaw of the operator SES agreed with the findings of Seradata that reliability probably had improved. He and some other participants had reservations about the future trend given the advent of new satellite technologies. There was a nearly even split (just yes) about whether this improving in orbit reliability trend would continue.

After strong defence of MGAs (Managing General Agents) by Morten Pahle, Managing Director of Vivet (which is connected to Elseco), the panel, and the conference as a whole, came to the conclusion that they are good for the market. There was a near total vote in favour of this motion despite public concerns that MGAs have no direct financial stake in any space risk and private concerns over their claims handling procedures. With respect to the accusation that they had no “skin in the game”, while he does have certain concerns over MGAs’ claims handling procedures, Marsh broker Simon Davies responded by saying that their fortunes were nevertheless still closely linked to their underwriting performance.

After the financial failure of NewSat, there was an acceptance at the conference that Export Credit agencies had let some weak companies otherwise prosper just to get exports in. The vote on this was yes – this had probably happened.

After the panel there were two short technical presentations, one on emergency thrust vector controlled solid rocket systems from Denis Bensoussan, underwriter at Beazley, and one from Don Greiman whose Peerless Technologies organisation specialises in imaging launched and orbiting objects from Earth. He gained a lot of interest from underwriters in the audience.