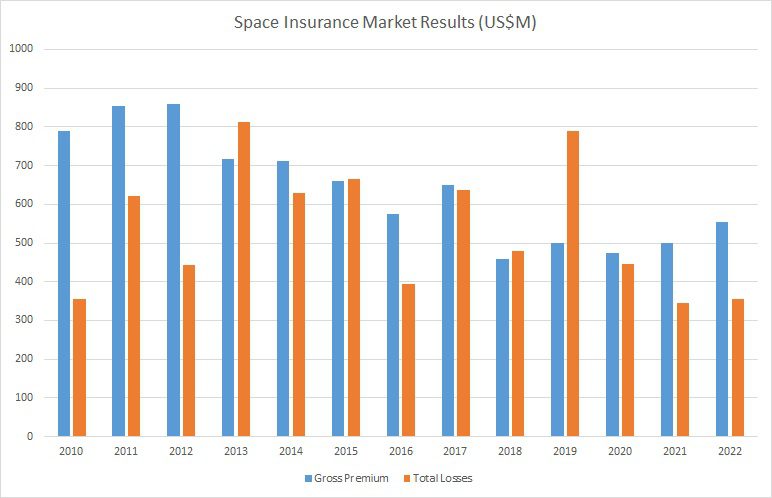

Twice a year, Seradata takes a small survey of space underwriters to find out what typical premium rates are for rocket launches, and typical GEO and SSO (Sun-synchronous orbit) satellites (the results are available in a report on the documents section of the Seradata launch and spacecraft subscription database). Last year’s profitable result for the market (gross premium income minus losses was circa US$200 million) might have been expected to drive premium rates downwards as capacity was attracted, but this year is in fact proving to be more stable.

Some rates have risen, usually due to a fall in reliability – others have fallen as confidence in them has grown. But overall, there has been stability with a hiatus in the slow reduction trend. This was partly halted by the shock of the insured loss of the Vega C flight (losing US$225 million for Pleiades NEO 5 and NEO 6). Meanwhile, the market has got used to the loss of Russian income. For a while last year, premium rate reductions were driven by a rushed hunt for alternative income.

After some loss of capacity, overall market capacity is now stable with enough to cover most insured risks – although there can be a large variation in rates on a particular risk. Brokers can still struggle to place a risk if the insured value is very large. Aviation insurance rates are rebounding (due to rises driven by the likely losses caused by the impounding of Western-built aircraft in Russia) and this may make reinsurance hard to come by for space insurers.

Even though rates are stable, there may yet be a drop in premium income. While there are some large, complicated and heavily insured spacecraft about to be launched, a dearth of satellite orders for GEO a few years ago is now feeding through into the premium total. Nevertheless, premium arriving from delayed 2022 launches may make up for this and the overall amount may actually be similar to last year’s total of circa US$550 million.

Some underwriters remain pessimistic about the overall result, especially over the arrival of new launch vehicles which are expected to be less reliable in their early flights on which some insured payloads are expected to fly. The maiden H3 launch failure of ALOS-3 was one of these, albeit that its insured value was relatively small.

One interesting factor to note is the worsening sentiment of underwriters towards Arianespace. Contributing to this have been the launch failures of the Vega and Vega C family, the relatively recent problems involving satellites being damaged by fairings on Ariane 5 flights, a faulty launch involving a targeting error and delays to the introduction of Ariane 6. This has led some underwriters to wonder if Arianespace has now lost its crown as the “gold standard” in reliability.