Speaking at the Seradata Space Conference in London on 20 June, Stéphan Rives, the global head of reinsurer SCOR, set out the current status of the space insurance market. He noted falling premiums after a profitable year – with premiums at historically low levels – but cautioned that new launchers and their traditional unreliability might change all that.

The event, which remains the leading forum for space insurance underwriters and brokers to meet their clients, included a panel discussion on the changing space insurance marketplace. A later broker feedback session saw space insurance brokers battling on behalf of their clients. Yamin Mustafa, of Marsh Space Projects, emphasised that the impact of market conditions on the sector’s stability was simply the result of the market cycle. The underwriters on the panel looked unconvinced.

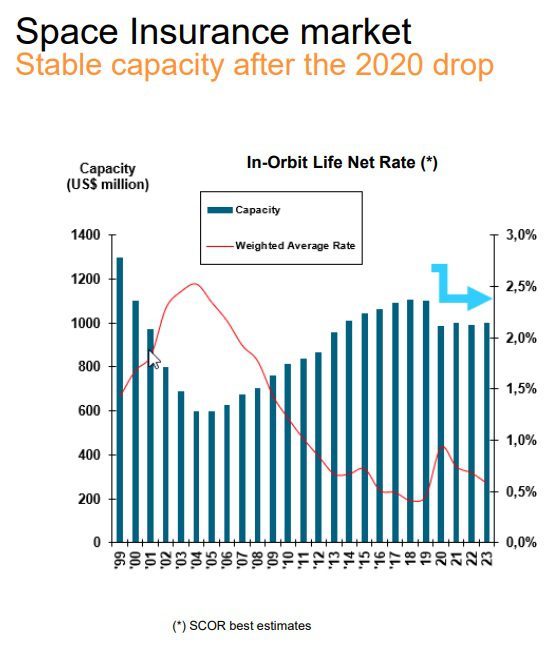

In orbit rates have fallen but market capacity is stable. Courtesy: Scor

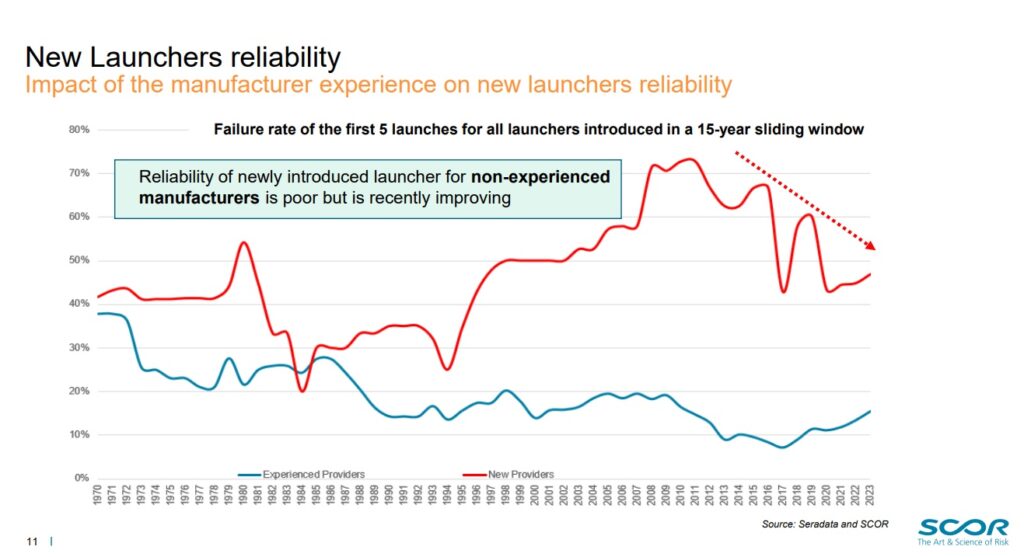

Analysis presented by Rives showed that, in terms of reliability, experienced manufacturers had the upper hand compared with start-up entrants to the industry, but the latter did seem to improve with time. For example, start-ups were increasingly hiring staff from their more experienced competitors.

The issue is pertinent because the sector is seeing a large number of new launcher projects, which it relies on to meet increased demand. Launcher reliability normally takes more than 20 flights to stabilise, according to Rives.

New entrants to launch operations have higher failure rates than the experienced operators – but learn fast from their mistakes. Courtesy: Scor

Charles Thornton, of Northrop Grumman, looked forward to the new world of insuring commercial space stations and lunar systems, but wondered if lunar rovers would need space or automobile insurance. While he noted many opportunities for space insurers, with the advent of manufacturing and terrestrial opportunities on the Moon, and the replacement of the ISS, these also presented significant challenges. Coverage breadth and limits for human spaceflight and astronaut harm were among these challenges, alongside cyber threats and factoring in the long-term needs for lunar exploration.

Another speaker on the panel, Denis Bensoussan, head of space at Beazley, observed that insurance was not making any real inroads into the LEO market, with only about three per cent of these satellites currently insured.

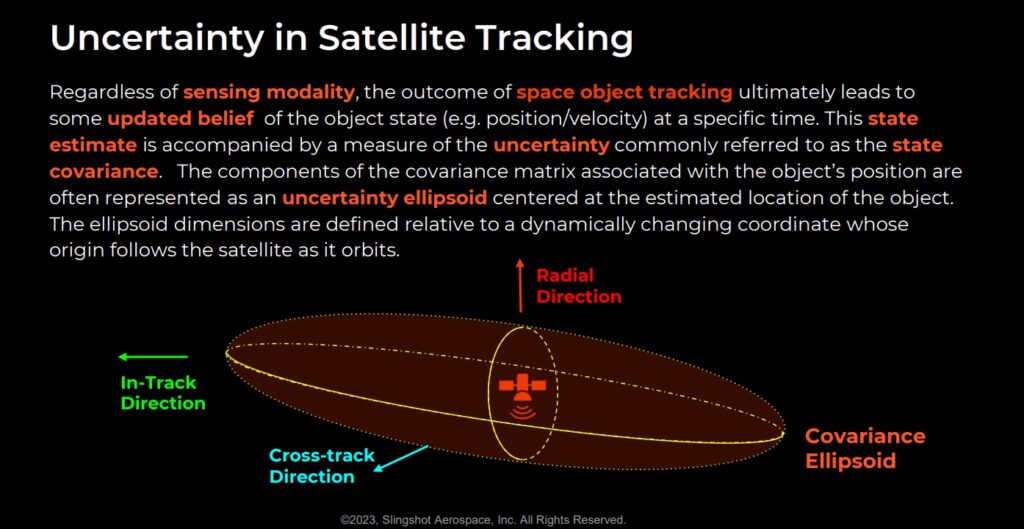

The risk of conjunction and collision is starting to exercise the insurance market, especially in LEO orbits, according to Belinda Marchand of Seradata’s US owner, Slingshot Aerospace. Marchand described how Slingshot systems could reduce this risk via conjunction screening. She explained the “uncertainty ellipsoid” and difference between “aleatory uncertainty” and “epistemic uncertainty”. The former is mechanism uncertainty while the latter is due to information uncertainty.

Participants at the conference were asked to vote on whether conjunction risk should affect rates. The room was divided but, by a small margin, the majority of insurers voted in the affirmative: that LEO conjunction risk does affect rates.

Space lawyer Joanne Wheeler, of Alden, quoted His Majesty King Charles III saying: “We must develop a sustainable way, a durable way, of benefiting from space, just as much as here on the Earth.” Wheeler, along with underwriters, was due to meet the monarch to discuss space sustainability.

Nevertheless, questions remain. For example, if a company could prove that it was acting in a responsible and sustainable way, should it get lower premium quotes from space insurers? Few underwriters were willing to say a definite yes.

Slingshot Aerospace’s Chief Scientists answers a question as Alden lawyer Joanne Wheeler looks on. Courtesy: Seradata/Derek Goddard