Introduction

Held in Dubai every two years and organised by the underwriting agency Elseco, the World Space Risk Forum has now become the pre-eminent conference on space insurance. Space Insurers, brokers, satellite operators, manufacturers and launch providers along with an assortment of lawyers, financiers, and journalists all came to the Raffles Hotel in Dubai in May. They came to discuss the recent results, threats and opportunities for this high risk/high return business.

The conference was attended by over 300 executives from the industry. The only notable absentees were a few of the major satellite operators and the US manufacturers Boeing and Lockheed Martin. However, the turnout of the space insurance market was very impressive with most of the big wheels of the World’s insurers, brokers and reinsurers being there.

Having a theme of “capital, applications and threats”, this year’s conference discussed the usual subjects: Reliability in space, how to handle claims, liability claims, forecasts of future demand and what new spacecraft trends were on the horizon.

With so much to get through, it was decided to split the conference into two for some periods allowing attendees to pick which “focus group” strand of subjects they wanted to attend.

However, the formal lectures and break-out panels were only part of the story. The business side of such a grand meeting place also requires sideshow meetings between brokers and their clients, between technical teams and their insurers, between launch providers and their potential passengers. And of course there is a social side – meeting old friends in the business – good natured joshing with competitors – and finding new friends to do work or play with.

To help this along a series of sporting events were organised including a sponsored golf event, a 5km run, and a sponsored cycle ride – all in the searing heat of Dubai.

For those a little less athletic there was also a jolly cocktail party held on a high terrace bar in the Raffles hotel, the venue of the forum, with swoony views of this city and the Burj Khalifa tower in the distance.

To make the conference more interactive in this new era of mobile technology, the organisers Elseco arranged for all attendees to have access to Google Nexus tablet computers. This allowed them to interact with each other, vote on questions posed in the presentations, and have access to interviews, news and information stemming from the event.

Recent trends and results

After a welcome address by Jeff Cassidy, a long-time space underwriter for Global Aerospace, and a brief message from Omran Sharaf of EIAST (Emirates Institution for Advanced Science and Technology) mentioning EIAST’s Dubaisat 1 and 2 and Khalifasat programmes it was left to Chris Kunstadter, Space Underwriter at XL Group, who was the official Chairman of WSRF to set the scene with an overview of interesting recent trends.

With respect to the trends in commercial satellite manufacturing, he noted that Space Systems Loral and Astrium continued to dominate the business and that industry giant Lockheed Martin was more content to go after US Government spacecraft business than bother too much with going after commercial orders. More surprising was that of the active insured commercial satellites some 27% were of Chinese or Russian origin and that these nations were now making major inroads into the sector.

Later in the Discovering New Missions Focus group, Tien Ye of the Chinese Academy of Space Technology (CAST) had detailed her firm’s new wares including the DFH-4SP all electric version of the DFH-4 spacecraft and the upcoming large DFH-5 which is designed to be launched on the Long March 5.

Kunstadter explained that commercial satellite orders were stable but did note the trend of satellites splitting into large and smaller spacecraft with little in between. He suggested that constructors were designing their spacecraft according to the limits of available launch vehicles. Kunstadter noted the very rapid growth of very small 1-3kg cubesats which now account for nearly half of all launched satellites.

On the state of the space insurance market, Kunstadter reminded the audience of the large potential for market volatility with so much insurance financial risk being spread on so actual few risks. While volatility can mean big profits as well as big losses, Kunstadter warned that the latter was more likely given that overcapacity and “soft market” had resulted in falling premium rates and a ratio of premium revenue relative to recent individual peak losses falling to just 1.2. On the second day of the forum, Antoine Bavandi of Argo International seemed to agree with Kunstadter warned that while the frequency of insurance claims had gone down, the “amplitude” (size) of the claims had risen.

While not everyone agrees with the premium totals Kunstadter presented (most think his figures are too high), the audience seemed to agree with his conclusion that 2013 would likely be counted as a small losing year for the space insurance market.

Kunstadter noted that of the 40 space insurers around the world, individual insurance companies were becoming proportionately usurped by MGAs (Managing General Agents) representing capacity from several insurance companies. His assessment was that that there is currently US$750 million in theoretical capacity for launch (plus one) risks, while in orbit capacity for individual satellite risk was at US$550 million.

Of the other threats Kunstadter briefly mentioned the potential for cyber-attacks, the threat of counterfeit parts and the potential pitfalls of using new untried technologies. Cyber attacks were later discussed in the last day’s panel by Dennis Fisher of Kaspersky Lab who rated people ahead of ground stations and terminals as the weakest link in any cyber security system.

Kunstadter reminded the audience that quality control remained an issue and that aging workforces within space companies would soon lead to a loss of know-how.

Satellite operators were still likely to insure their spacecraft – at least for the launch and first year – the riskiest periods of a spacecraft’s lifespan but that in orbit insurance is still regarded as poor value for money despite declining premium rates. The overall insured value of all covered satellites in orbit was estimated by Kunstadter as being US$26 billion.

Of the anomalies that cause insurance losses, Chris Kunstadter noted electrical power faults were still the most frequent cause of in orbit claims.

Romain Bausch in a valedictory speech as he stepped down from being CEO of SES (though he will become Chairman of the Board at the beginning of next year) noted that new technology was going to happen which would drive the industry including IP networked communication and ultra-high definition television. With respect to spectrum Bausch warned that terrestrial mobile operators were still intent on moving onto satellite operators’ spectrum. Bausch reiterated the trend that new space manufacturers and launch providers were emerging including those in China.

Bausch underlined that his firm strove for reliability and that SES engineers and inspectors were closely involved in the manufacture of their satellites at the firms they had appointed. However, Bausch noted that insurance was still needed and that the Proton launch failure-induced loss of Astra 1K in 2002 was one of his most difficult moments during his leadership of SES.

Capital and economics – how to get and keep the money

Philippe Cotelle of Airbus Defence and Space, lamented that Public Private Partnership (PPP) financing schemes were not used more readily noting that the UK Ministry of Defence was very happy with its successful PPP-funded Skynet 5 communications satellite programme. Instead Cotelle noted that national governments usually preferred to finance and retain their own assets. Cotelle did not adequately answer the question why such PPP schemes would be likely to be favoured by governments after PPP/PFI (Private Finance Initiative) schemes fell into disrepute in UK projects involving the construction of schools and hospitals when they were found to be scandalously poor value for the UK taxpayer.

Alan Khalili of Aerion (formerly of Iridium) noted that the best financing deal was usually the key factor in the selection of a spacecraft manufacturer. The deal to produce the next generation of Iridium satellites went to Thales Alenia Space was backed by US$1.9 billion funding from the French export credit agency Coface. Some, including Jan Schmidt of Swiss Re, wondered if such funding was a good thing as Export Credit Agencies could allow high risk enterprises to get funding more easily than they might otherwise do so.

Chris Quilty of the Investment bank Raymond James made some interesting comments about how space firms usually ended up being in the hands of major defence and aerospace companies a few years after their IPO (Initial Public Offering). He noted the excellent profitability and cash generating ability of a satellite operator compared to a spacecraft manufacturer.

When asked how he would value and rate a start-up firm like SpaceX for financing, Quilty noted that while Elon Musk had a certain “star quality”, other factors were more important. “At the end of the day investors look for cash flow”, Quilty said. “Markets are cold and rational about that.”

Quilty also noted that mobile satellite companies “have to spend all the capital upfront” though he preferred not be investing in brand new concepts. Remembering the initial financial debacles of Iridium and Globalstar, Quilty said “The dirty little secret of the space industry is not to invest in the first to the market”.

Having adequate space insurance was noted by Jan Schmidt of Swiss Re as also being a key factor in gaining financing and loans.

At the smaller end of the scale firms can sometimes use finance from their holding companies. Peter Mabson of exactEarth noted that his firm had spotted a need for low cost ship tracking and using a very small investment of US$80 million from shareholders ComDev (73%) and Hisdesat (27%) had created a low cost constellation consisting of two microsatellites, four nanosatellites and 2 hosted payloads on other satellites in equatorial and polar orbit. The result was that major ships could now be tracked using a continuously transmitting transponder as part of the AIS system. Having begun its service in 2010, the firm is now cash flow positive and expects to become fully profitable in 2015. The firm expects to offer cheaper transponder systems for smaller-sized ships shortly.

On the technical front, Mabson noted that the use of low cost technology required his satellites to sometimes perform electronic resets after solar weather caused bit flips etc. He also noted the difficulty in getting to certain orbits, relying on going as co-payloads on certain launches.

Economist, Dr Kurt Karl of Swiss Re, reminded the forum that interest rates had a more or less direct effect on the profitability of the insurance market as the firms strived to get an extra return from their premium income. Space Insurance, Dr Karl noted, had to fight against other classes of business for capacity and that rates had to harden for space insurance profitability to be retained. Having said that, it was noted in one of the later break out focus groups that certain space underwriters who had struggled to gain their capacity, were also the ones that appeared to be most reticent to use it fully.

While telecommunications demand in the Asia-Pacific region would increase, China, Dr Karl warned, could be facing a “hard landing” after spending its way into debt to stay out of recession. In the longer term Karl warned that China’s controversial one child policy would actually stymie their growth rate as their working population declined. India, Karl noted, would become an economically more important nation from 2030 onwards.

One bright spot of “global warming” would be for the space industry as demand for weather satellites would increase.

Dr Karl noted that there was an increased risk of global conflict but that this could be beneficial to space activity, if not to overall world economic activity.

On a smaller scale, Doraisamy Balakrishnan, Chief Financial Officer of the regional operator Yahsat described how his firm took a step-by-step approach to convincing finance houses to give them the funding their needed. A proper market analysis and business plan and a “transparent” assessment of the risks were seen as essential to providing confidence that it is a safe investment. The firm, as part of telling its good story, also has to prove it has the necessary expertise and resources including the rights to orbital positions in the geostationary Earth orbit.

How to ensure high reliability

Anne Aufrere of the launch provider Arianespace reminded the conference that “reliability takes years to build…seconds to break…and years to repair.” Arianespace‘s own surveys had found that after cost, recent good reliability was the most important attribute that a launch provider could offer.

Kirk Pysher of International Launch Services (ILS) noted that launch providers and satellite companies should “Find what works and stick to it” before accepting that “change is inevitable.” In his presentation he noted that Proton would soon be in its final Phase IV configuration needing no more changes except for the new 4m stretched fairing that would allow a greater variety of dual satellite launches. He noted that Proton could launch smaller “all electric” satellites to a higher drop off point – allowing them to avoid long and dangerous transits though the high energy particles of the Van Allen Belts.

Pysher warned that over supply would drive down launch prices, but that this could drive out reliable launch vehicles. Pysher avoided the embarrassment of the latest Proton launch failure happening during the forum. It occurred on the evening of the last day of the conference after all the participants had left.

In the Twenty Year Outlook focus group, Philippe Francken of SES noted that new technology was inevitable including the increasing use of electric propulsion.

Antoine Bavandi of Argo International warned that spacecraft were increasingly using COTS (Commercial Off–The-Shelf) hardware which had not been properly tested. This, along with increasingly tight delivery schedules could mean increasing losses.

However, in his WSRF newsletter interview, Laurent Lemaire of Elseco reminded readers that new technology was not necessarily a bad thing for reliability, it might even improve it.

Brian Kosinsky of the satellite manufacturer, Space System/Loral noted that it was possible to safely introduce new technology but that it had to be done with care and that the attitude to quality had to come from a firm’s top management. He further noted that safety is “more important than schedule.”

Ray Johnson of the Aerospace Corporation noted that his firm was the appointed organisation to perform “mission assurance” analysis on various launch vehicles to be used to launch US Department of Defense spacecraft. As he described the process, Johnson drew a parallel with the similar analysis performed by underwriters on the insurance space market. Johnson admitted in a reply to a question that just as the leading edge damage/re-entry failure mechanism of the Space Shuttle Columbia (STS-107) had not been foreseen, there would always be types of failure that would not be picked up by any mission assurance analysis.

For small manufacturers cooperation is the key

One small satellite manufacturer that has risen in importance is Surrey Satellite Technology Limited (SSTL). Andy Bradford noted the advances that his small satellite manufacturing firm (now wholly owned by Airbus but independently run) has achieved. SSTL started by building small satellites for itself and then moved to cooperative ventures with small nations wanting to learn space technology for themselves. The firm moved on to having the breakthrough of being selected by ESA as prime manufacturer to build the GIOVE-A, a precursor test satellite for the Galileo navigation system.

Bradford noted that the firm had introduced new technology with this satellite including deployable solar arrays and active safe modes on GIOVE-A, progressing to having to the steerable downlinks on Nigeriasat.

The firm has now moved to building fully fledged GEO satellites and has, after a long wait, finally signed its first order for its GMP-T bus – though the customer has yet to be formally disclosed. As the firm looks forward to this and to the construction of the Novasar radar satellite constellation, Bradford admitted that there was a tension between staying loyal to its smaller customers and to those wanting bigger and better things for the firm.

Possibly to the chagrin of SSTL, their one-time trainees at the Satrec Initiative of South Korea have been active in helping EIAST build the Dubaisat 1 and 2 spacecraft. Adnan Al Rais of EIAST revealed however that the follow-on Khalifasat will be built in house by EIAST albeit that some component parts will be supplied from elsewhere. If all goes to plan Khalifasat will be launched in 2017.

…while cooperation remains essential for start-up operators

As a small start-up operator the Qatar-based satellite operator Es’shailsat decided to form an alliance with European satellite operator Eutelsat in 2010, not least to gain access to the firm’s 25.5 degrees East GEO orbital slot and to its operational expertise.

The idea was that the Arab world will have access to the respected Al Jjazeerah news channel from the Es’shail 1 satellite operating at 25.5 degrees East which was close enough to the Arabsat operating location at 26 degrees East so that Direct-to-Home (DTV) television customers would not have to move their receiving dishes way from their normal Arabsat channels.

In the “Growing up in Space” focus group, Saif Mansoor Al-Khaldi, Satellite Projects Director at Es’shailsat explained that the firm plans to launch Es’hail 2 in late 2016.

“Under the terms of the agreement, Es’hailSat have acquired the rights to 500MHz of premium Ku-band bandwidth at the 26.0 East TV broadcasting hot-spot. Es’hailSat’s second satellite, Es’hail 2, will use these frequencies and will be designed to provide DTH and other telecommunications services from the 26 degrees East hot spot” said Al-Khaldi.

Eshail 2 will be especially designed to provide higher power spot beams less susceptible to jamming (unfriendly nations and organisations have been jamming Al Jazeerah – most irritatingly for the station during World Cup 2010 football matches it was covering).

There will also be a Ka-band payload carried on behalf of the Government of Qatar for military and other uses. Al-Khaldi explained that while Es’hailsat plans to operate the satellite themselves this time around, they are teaming up with a world class satellite operator to develop the design and operation concept for a new teleport which will be located north of Qatar.

A third Es’hail satellite is now in the planning stage. This is unlikely to be targeting MENA (Middle East/North Africa) DTH audience, instead it will be targeting different telecom services beyond MENA. Eshail 3 will potentially include hosted payloads to support government missions such mission could be sensors for weather forecasting.

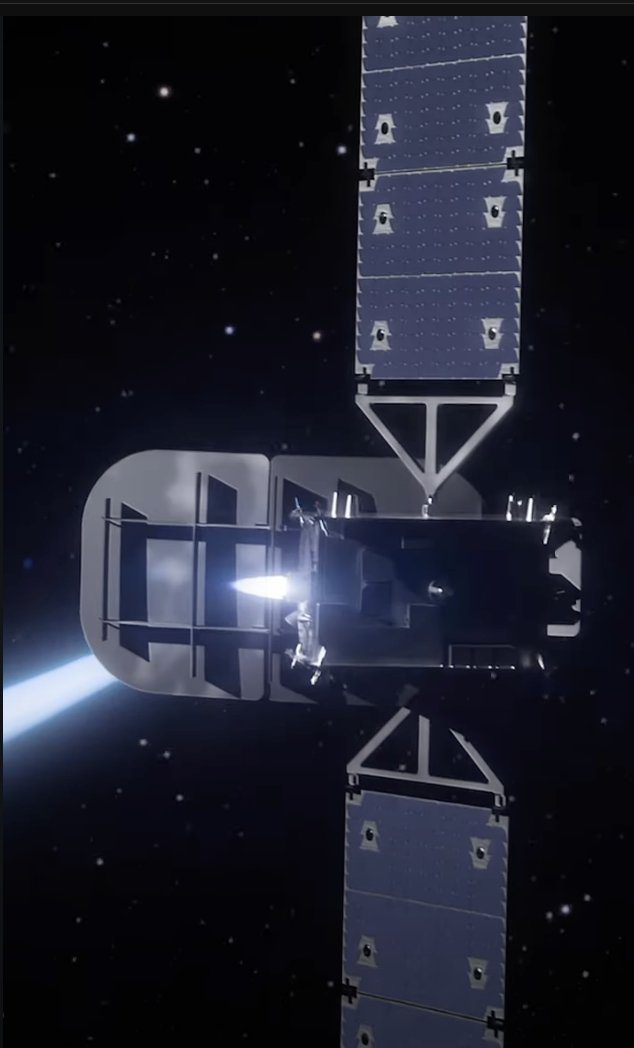

Of course, if either these satellites’ final orbit positioning fails there will soon be the potential for rescue if Bryan McGuirk of Vivisat has his way. His firm, along with its backers ATK and US Space, plans to build and launch a space tug called the Mission Extension Vehicle (MEV) which is designed for a variety of tasks from removing inclination and deorbiting satellites to rescuing those in the wrong orbit. The craft will be marketed as a leased service to any host satellite and has three satellite operators signed up as potential users.

Comment by David Todd: The WSRF was a good conference – though there were a few errors

Overall the conference was good and instructive with some interesting topic areas. It was especially interesting to find out how and why start up firms decided to get into the space business and how they turned a dream into reality. The Raffles hotel venue was good and clean with good washrooms, and the food and refreshments provided in the various sponsored luncheons and tea-breaks was also of good quality. Importantly, the air conditioning worked very well.

The use of interactive voting was a good idea – but it has been done better elsewhere using much simpler technology and sensibly done with fewer questions to vote on. It was noticeable how few of the audience actually participated in the voting. Meanwhile the electronic interactive questioning from the audience was not successful with most preferring the good old microphone to ask their questions. However, providing Google Nexus tablets was worth trying as it is probably the future of such conference resourcing – even if there were some teething troubles. For example, the electronic version of the newsletter had some technical issues which prevented it being read and it was not until it was e-mailed later that participants could do so using their own computers etc. Meanwhile, attendees were warned off using the Nexus online systems too much in case the conference wifi got overloaded. Perhaps a better hi-tech solution would have been to provide a special website to allow punters to access the voting and other conference systems using their own mobile devices…laptops, smart phones, tablets etc.

On the voting front, one participant suggested that it might have been better to have a before and after the debate vote. That is, a question would be put to the audience and then the debate would be made after which it would be interesting to see if the voting had changed as a result.

Splitting the conference into two different strands of “focus groups” worked but was also frustrating. You could not be in two places as once! As a result, this writer had to ask his friends how some of the other ones went. However, the focus groups were appreciated for their relative intimacy – but only if the smaller Luxor room was used. The main hall was too large for this.

There was something else missing at this gig. A good old pow-wow argument! While it does sometimes descend into the same-old arguments – it is always fun having brokers and underwriters trading witty putdowns from opposing sides.

There was some quick and amusing wit on display of course. Peter Elson of Broker JLT is proving himself over a succession of these conferences to be the great wit of the market. Of course, sadly there were also more than a few weaker speakers – either bent on promoting their companies and not keeping to the brief – or worse, not keeping to their times – and ruining it for follow-on speakers. There was also a surfeit of lawyers, some of which were on panels where they really had no place to be.

Having said that one of the better focus groups – though perhaps it could have been played more interactively – was the “When Problems Arise” session lead by Nick Hughes, space lawyer at Holman Fenwick and Willan (HFW). He was ably assisted by the videoed acting abilities of HWF consultant David Greves as he played a newsreader.

The panel went through various moot/mock scenarios of a claims, subrogation and liability issues along with the contrasting complexity of points of international law and the moral hazard of insuring loss of incentives. It made one think that those “boring and unloved” space lawyers are sometimes really needed.

Lee Davis of Atrium contributed to this piece

The full set of WSRF presentations is available at: http://worldspaceriskforum.com/2014/presentations/

For some of the amusements of the WSRF conference see: https://www.seradata.com/SSI/2014/05/world-space-risk-forum-sketch-and-amusements-holding-out-for-hot-babes-good-luck-logos-and-the-queens-hat/